As someone who has spent a lot of time building marketplaces in my career, a curious thing has happened over the last couple years. Founders have started reaching out asking for help converting their SAAS or SAAS-like business into a marketplace. The approach sounds a bit like this:

- I’ve amassed a large group of X type of professionals

- I’ve helped their business, but they’re asking for help driving more customers

- Since I already have the supply, it should be easy to build the demand side to have a successful marketplace

- My customers will be happy, retain better, and I’ll be able to charge them more

So goes the story. Now, this story itself explains why many businesses fail to make the conversion to marketplace. If driving more customers was your customers’ #1 need, and that’s not what you helped them with, you probably didn’t build a very successful business, or the problem of solving customer acquisition for that market is very difficult.

What Types of Businesses Are We Talking About?

Before we go any further, we should talk about what these businesses look like, and what they mean when they ask about becoming a marketplace. Many of the terms we use to define businesses today are features of the business rather than an encompassing definition, like the words SAAS or platform, which makes them not very useful. Note: I am blatantly stealing Brandon Chu’s platform definitions for this. Let’s break down these definitions so we know where we’re at:

- SAAS: software that businesses access online and purchase via a subscription e.g. Slack, Adobe, Atlassian

- SAAS-like: any number of different models where a business sells software to businesses online, but does not charge via a subscription e.g. transactional or pre-revenue

- Marketplace: a business where sellers (frequently businesses) provide their services on a platform to attract additional buyers, and buyers come to this marketplace to seek out these services and find new suppliers. Marketplaces commonly process the transaction and charge a commission to either the supplier or the demander. If not, they usually charge some sort of lead generation fee to the supplier.

- Developer platform: a business where developers can build businesses on top of the business’s software and charge customers. The end customer is usually not aware this company even exists e.g. Stripe, Twilio, Amazon Web Services

- Extension platform: a business that enables other developers to make your product better where the platform owns the relationship with the customer and provides some of the direct value itself e.g. Shopify, WordPress, Salesforce

- Networks: a type of platform where consumers interact with each other and/or content on the platform in a non-transactional way e.g. LinkedIn, Pinterest, Yelp

So, when we talk about businesses trying to become marketplaces, what we’re talking about usually is sellers of software to businesses trying to help those same businesses attract more buyers by aggregating buyers on their platform and aiding in the discovery of those buyers finding the businesses the company currently counts as customers.

The Weak Transition to Marketplace Arguments

Why is there a sudden demand of founders looking at this strategy? There are three fairly weak arguments I don’t like, but I’ll present them anyway.

#1 Saturated Growth in SAAS

Perhaps it is a natural extension of the SAAS explosion the last ten years. Kevin Kwok and I have often discussed that growth at some scale equals an adjacent business model:

- Ecommerce businesses trend towards marketplaces over time e.g. Amazon

- Marketplaces trend towards vertical integration over time e.g. Zillow

- SAAS businesses trend towards extension platforms e.g. Salesforce

Perhaps as SAAS has moved into more niche verticals, the extension platform opportunities have dried up, so companies are looking at consumer marketplaces as a new potential growth lever. But SAAS companies continue to grow on the public markets. Perhaps as SAAS has expanded into industries where customer acquisition is difficult, they’ve found their businesses at best only solve the second most important problem for their customers.

#2 Desire for Market Networks

Perhaps it’s because of James Currier. He has blogged repeatedly about market networks being the companies of the future. These companies combine SAAS, marketplaces, and networks. But these founders are not using this term, and this supposed revolution looks no closer to happening five years after his original prediction. Some businesses attempting to build out market networks have become good SAAS businesses e.g. Outdoorsy with its Wheelbase product, but there is no evidence they’ve actually ended up building marketplaces or market networks. Honeybook has struggled, and Angellist and Houzz started as networks, not SAAS businesses. Angellist has never added a SAAS component. Houzz acquired IvyMark last year to launch a SAAS model after ecommerce, ads, and marketplace models for monetization disappointed, and it is too early to understand how well that is working. All evidence shows that if market networks are real, they are more likely to become them from starting as a marketplace or network first, then adding SAAS, not the other way around. Faire is a recent example of this.

#3 It Worked for OpenTable

Now this is a reason I actually hear. But it’s not a great one. The first reason is that OpenTable was a marketplace from day one. Customer acquisition was always a key value proposition, and they delivered on it. It wasn’t aspirational. Second, OpenTable is one of the largest public market disappointments of the last ten years. With an infinitely sized market, the company struggled, was acquired, and then written down significantly post-acquisition by Booking.com.

While these stories exist and do influence some founders, I do still think the main reason why is illustrated in the initial story above; it’s just the strange allure of ongoing customer development.

Why Changing Business Models and Customers is Always Hard

Ignoring the impetus for the rapid increase in desire for SAAS businesses to transform into marketplaces, let’s talk about why companies struggle to do this in practice, and how you fight these headwinds. Through my research and directly working with companies attempting these changes, I’ve identified some main barriers for this transition. If you can work through these barriers, your chances of making this mythical transition increase dramatically.

#1 Founders have to change the incentive structure for all or a significant percentage of the company

SAAS or SAAS-like businesses can grow very quickly. If you’ve spent a significant amount of years building a SAAS business and are considering the marketplace transition to drive additional growth and value to your customers, you’ve almost assuredly built a significantly large base of customers, still have growth targets on this core business, and are managing a lot of complexity already. What happens frequently is founders attempt to spin up a team to work on what’s usually a large, new addition to their current product offering. This initiative is considered a long term, strategic play. It’s important, but not urgent.

What happens to important, but not urgent, initiatives at fast growing companies? They usually get broken up by other important, but more urgent initiatives for the core business. Oh, our quarter was soft, and we need more resources to get back on track? Take them from the marketplace team. We’ll get back to it later. Have an initiative that could drive additional growth in the core business, but don’t have the resources? Take them from the marketplace team. We’ll get back to it later. And so on.

It’s always more attractive to take the more guaranteed optimization on the core business than risk those resources for the very long term, completely risky proposition that might drive a step change in growth for the business much later.

Fortunately, this issue is not new to fast growing companies, and there is a solution. In fact, we faced this very issue at Pinterest. Our largest strategic issue was international growth, but employees kept optimizing 1-2% changes in the U.S. business that moved the top line instead of international work that needed to begin from scratch. Founders usually have two tools to solve this problem. The first is to make the entire company’s growth revolve around this new initiative. That’s what Ben Silbermann did at Pinterest. The entire company was goaled on international growth at the expense of U.S. growth. And it worked.

The other tool is what usually happens at larger companies looking to expand into new product lines. They create a new team with separate goals and reporting lines. Frequently, they don’t even sit in the same building. This is what we did at Eventbrite. We created a Marketplace business unit with a GM reporting directly to the CEO. And while they sat in the same building, it had its own team and its own OKRs.

Changing the goals or creating an independent team with its own set of OKRs does not guarantee marketplace success, but they free you from the temptation of dismantling or impacting teams that frequently need to do years’ worth of work to find product/market fit for a second set of customers.

#2 Founders have to shepherd the right new and existing resources most likely to value the business model transition and change the company culture

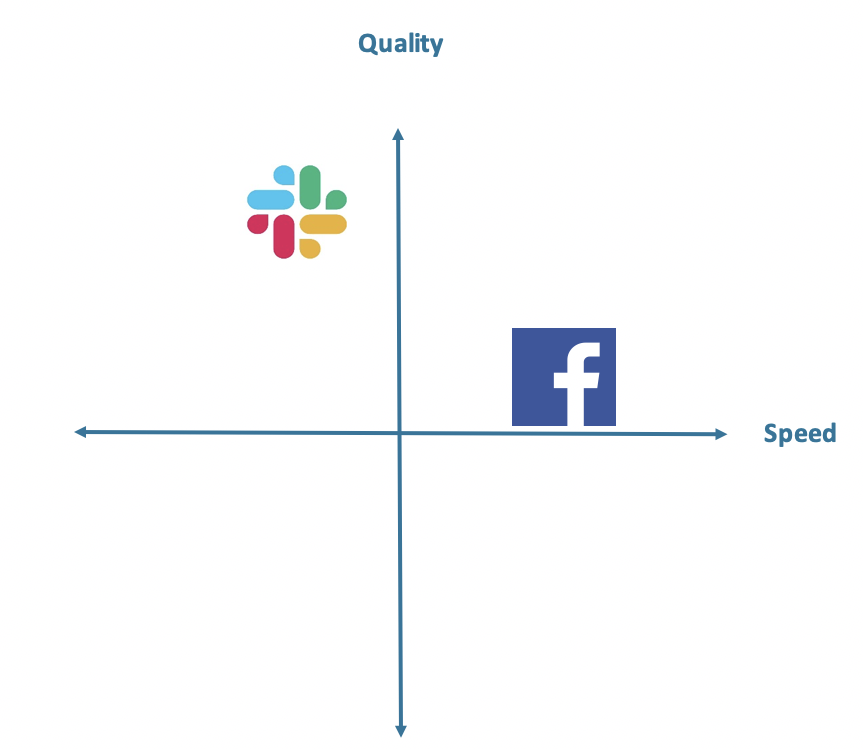

Strong businesses usually build a culture of understanding their customers and their model very well and catering to those needs. What happens when you suddenly ask those employees to care about a second customer, or a new business model, and potentially trade off the needs? Old habits die hard. Employees still default to doing what’s best for the current customer/business model even at the expense of the new customer. And even if they do want to care about the new type of customer, they may not have the DNA. Consumer and B2B cultures tend to be very different, for example, attract different types of talent, and there are very few people who are great at both.

Building B2B products can be very different from building consumer products, and many marketplaces (but not all) have consumers on the demand side. In this case, your customer is a less reliable narrator for their needs, so user research, while effective at identifying their problems, can be a lot less reliable at predicting what people will actually use. Consumer products require significantly more experimentation, and have the data to do it because there are so many more consumers than businesses.

This cultural issue frequently requires new blood in the organization and careful recruitment of internal resources that are more passionate about the opportunity and usually have some background in consumer product development. Usually, leaders are brought in to lead teams like this with heavy consumer backgrounds, and they recruit more new people with consumer backgrounds. The use of advisors with that kind of experience (like myself) is also common—to suggest product development best practices that may be better suited for the task, to prevent common marketplace-building mistakes, and to more objectively monitor if progress is occurring at the appropriate rate.

How to Be Better Positioned to Build a Marketplace

While transitioning to new customers and/or business models and described above is hard, there are a few ways to make the transition to a marketplace more likely to be successful from a SAAS-like business.

#1 Founders need to confirm there is a demand side to this market, and the way you would engage with them aligns to you and your customers’ business models

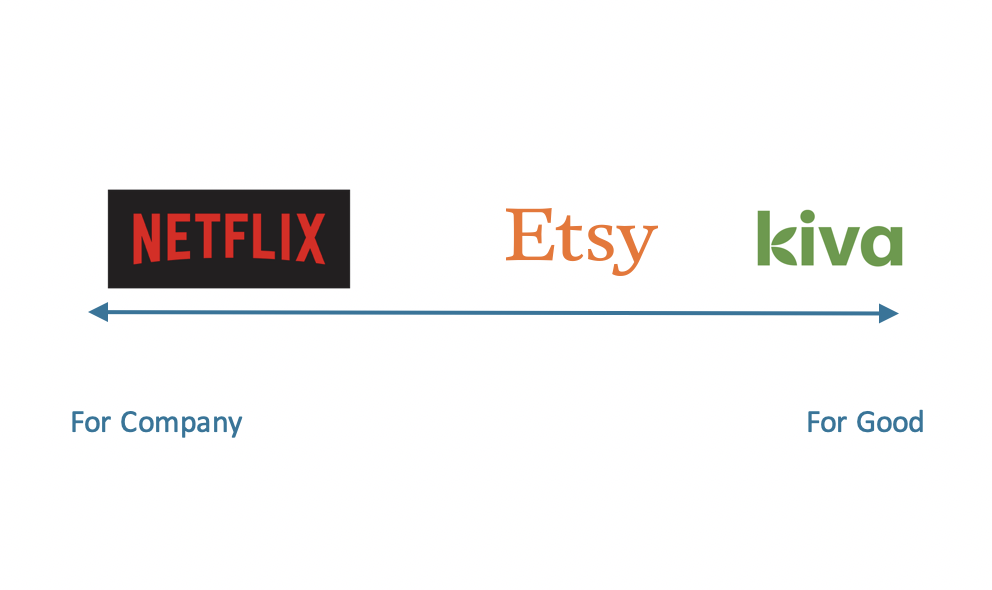

One major reason marketplace transitions fail is that there isn’t actually a demand side to this theoretical marketplace to be added. These companies are selling to the supply side of a theoretical marketplace, and don’t understand if demand exists. There are two shades of this I have seen. One is that the SAAS customers make their revenue not by selling something people want to buy and find more, but that people feel compelled to support financially. Let’s take GoFundMe or Patreon as an example. These companies would love to have consumers come to their websites and find people and causes to support. Patreon even tried this. But are consumers searching for websites where they can donate more of their money to artists and local causes? No, not really. Do they support artists and local causes? Of course, that’s why those businesses have done well. But consumers generally aren’t searching for more causes.

The second shade is that the marketplace opportunity is only to find a vendor once on the demand side. In these markets, once a consumer finds a provider for a service, they tend to stick with them for long periods of time. Let’s say you are looking for a babysitter. If you find one that works for you, you stick with that person for a long time. This is in contrast to ordering food, where variety is a feature, not a bug, of the decision-making process. While successful marketplaces have been built in these areas, they are harder to build. SAAS companies struggle to transition in these markets because they have to build trust signals that may damage their relationships with their clients, and there are generally better platforms for researching these vendors than on the SAAS platform e.g. Yelp for local restaurants and services, Tripadvisor for hotels, and G2 Crowd for software. Also, how should the SAAS tool price these additional customers? Just once for the acquisition, or every time they use the product in the future? The clients and the company will usually be misaligned on this, creating leakage. In this case, the business model for the marketplace doesn’t align with the business model for the SAAS business or the SAAS customer. In a weird way, by trying to address the biggest problem you heard from your customers, you built a product that doesn’t work for that need, but for your own.

Again, this is a solvable issue. It can be mitigated through a lot of customer research on the demand side. Not only understanding the consumer your clients are targeting, but finding a critical pain point for them that isn’t solved on the market by another product that your company can actually solve due to its relationships with all of the suppliers in the market. Then, try to align revenue to the value you create in a way your SAAS customers will understand. And be prepared not to capture all of the value.

#2 Make sure the opportunity actually aligns to the characteristics of other successful marketplaces

Transitioning to a marketplace effectively requires founders to understand what makes a successful marketplace, and those characteristics are surprisingly opaque to people who haven’t worked on marketplaces. Rather than reinvent the wheel, I encourage founders to read Bill Gurley’s treatise on 10 factors to consider for marketplaces. One other factor Bill neglects to mention that is important is that normally marketplaces are built on top of under-utilized fixed assets:

- Excess kitchen space for Grubhub

- Idle cars for Uber/Lyft and Getaround/Turo

- Empty bedrooms for Airbnb

- Empty land for Hipcamp

- Empty hotel rooms for Booking.com/Expedia

- Excess SMB Inventory for Groupon

Do your current customers have this characteristic?

Can the Transition to Marketplace Ever Work?

It’s clear that evolving a SAAS business to a marketplace is an emerging strategy that more and more founders will research. What is important is to make sure you’re doing it for the right reasons, and that you’re prepared to fight the main barriers that prevent this transition from working. It’s also important to remember that even if you fight these barriers, this transition takes time. Marketplaces tend to take 2-3 years to find product/market fit. You need to be in a position where you can invest for that long before seeing a return.

In the Advanced Growth Strategy course, Kevin and I talk a lot about minimum scope. Minimum scope is the activation energy that makes a strategy viable. In the course, we talk about the minimum scope for cross side network effects to emerge. And in our examples, we do show that most cross side networks (but not all) emerge with the supply side first. But you have to remember that you do have to hit minimum scope for the demand side as well. And many businesses find they do not have a good answer for this.

Another existential issue for founders looking at this transition is that it inverts the typical company building model. When building a company (especially if you are raising venture), you typically have different assumptions you have to validate to receive funding rounds and eventually build a successful, long-term business. The harder the assumption you validate, the more likely you are to be successful, and the easier a fund raise will be. Ask any founder whether building a SAAS business or a marketplace business is harder. I bet you almost all will answer that a marketplace is harder. With the SAAS to marketplace strategy, you defer the hardest part of your strategy.

When looking for inspiration, it’s true there isn’t a cohort of companies to emulate, and that’s scary. In fact, almost every other business model transition related to this has more data to support. Flexport started as a SAAS business from the demand side (called ImportGenius), and built a marketplace on top of it, for example. Almost all marketplaces add a SAAS component eventually to their model. But don’t be too scared if this is your strategy. If you can answer positively:

- Can I change the culture?

- Can I change the structure?

- Have I vetted a demand side exists?

- Does the demand side actually exhibit great marketplace characteristics?

Then you are off to a great start in building a new scalable model of growth for your business.

Have transition to marketplace questions? If so, hit me up in the comments.

Thanks to Kevin Kwok and Gemma Pollard for giving feedback on this post. Also thanks for Brandon Chu for letting me use his platform definitions.

Currently listening to my 2010s Shortlist playlist.