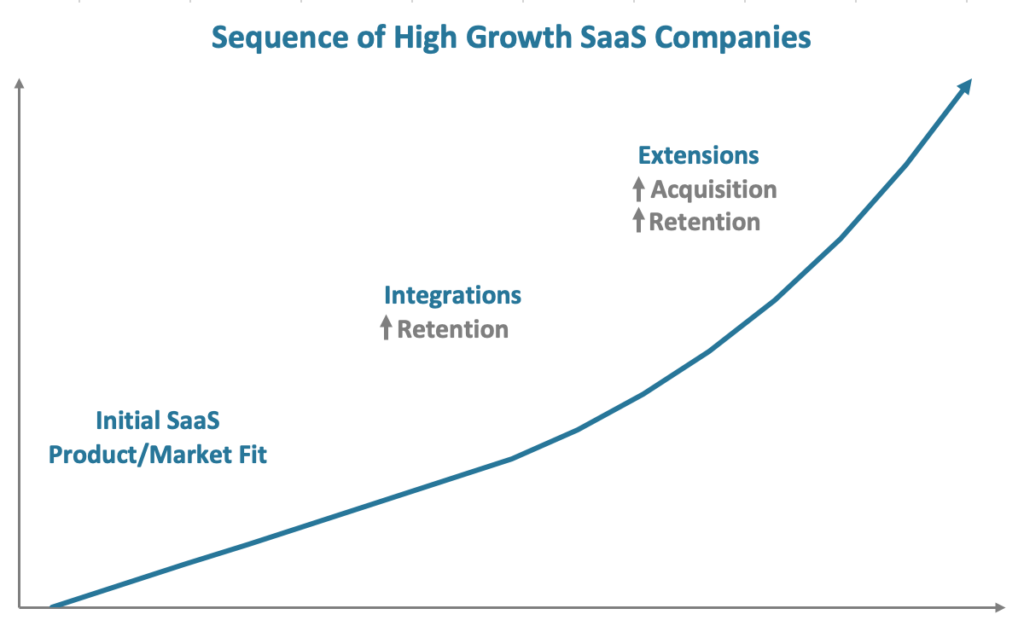

As a product leader with a background in growth, it’s surprising how much what I actually end up working on is product/market fit. Product people should only be focused on growth i.e. connecting people to the value of a product once they’ve confirmed the product is delivering value. So it’s important to have a strong understanding of what product/market fit looks like before investing in growth. Founders and product leaders struggle with answering this question however, and advice and blog posts on the internet frequently espouse that you’ll know product/market fit when you see it, and that all of a sudden everything will start working. It’s not very actionable advice. I don’t claim to be the world’s foremost expert, but this is what I learned through scaling multiple startups, launching new products, and advising and investing in dozens of companies.

The Quantitative Approach to Product/Market Fit

I define product/market fit as satisfaction that allows for sustained growth. Satisfaction is tricky to understand because, well, customers are rarely truly satisfied. Jeff Bezos frequently drops pearls of wisdom in his shareholder letters, and my favorite of them is the following:

One thing I love about customers is that they are divinely discontent. Their expectations are never static – they go up. It’s human nature. We didn’t ascend from our hunter-gatherer days by being satisfied. People have a voracious appetite for a better way, and yesterday’s ‘wow’ quickly becomes today’s ‘ordinary’.

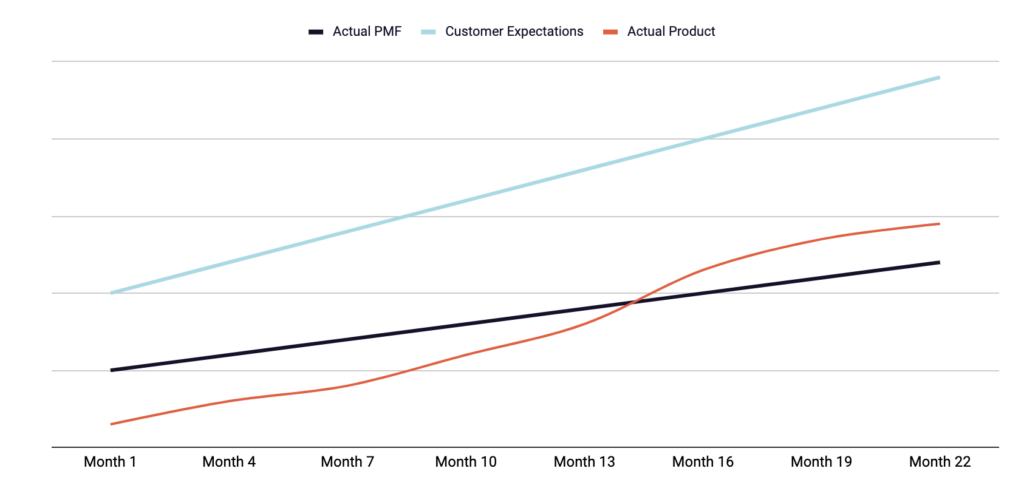

To put that in product/market fit parlance, product/market fit has a positive slope. The expectations of the customer continue to increase over time, and in fact, total satisfaction is likely an asymptote impossible to achieve. So what is product/market fit then? Product/market fit is not when customers stop complaining and are fully satisfied. They’ll never stop complaining. They’ll never be fully satisfied. Product/market fit is when they stop leaving. Represented visually, customer expectations are an asymptote a product experience can rarely hope to achieve, but product/market fit is a line a product can jump over and try to maintain a higher slope than over time.

All products start below a theoretical product/market fit line and some cross that line and work to stay above it over time.

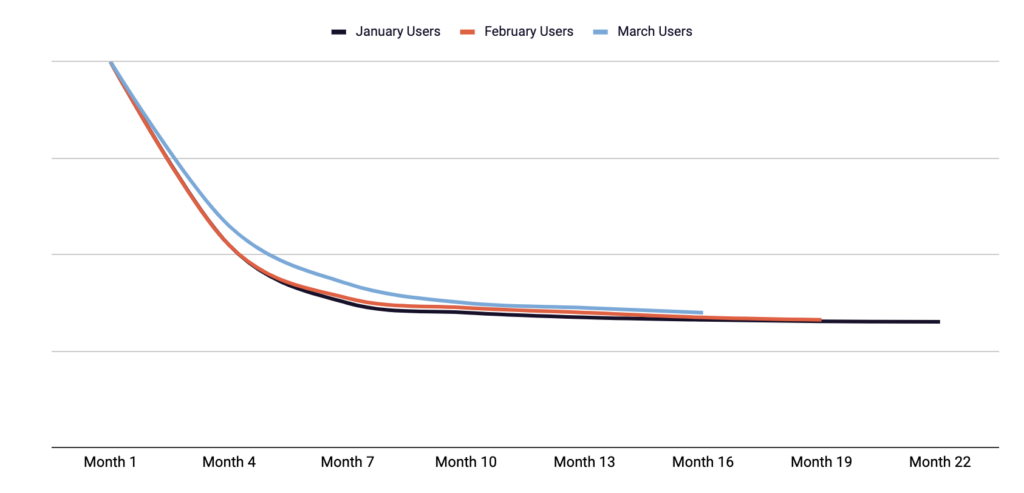

So, for most businesses, instead of measuring satisfaction, measuring retention is the best signal of product/market fit. Measuring retention is pretty easy. Perform a cohort analysis, graph the curve over time and see if there is a flattening of the retention curve. As I’ve discussed before, what you measure for your retention curve matters quite a bit though. For your product, there is usually a key action the customer takes in a product that best represents product value. For Pinterest, it was saving a piece of content. For Grubhub, it was ordering food online. For your product, there is also a natural frequency to product use. For Pinterest, we eventually determined that people would browse sites for topics of interest on a weekly basis. For Grubhub, people usually ordered food once or twice a month. Once you have a key action and a designated frequency, the cohort graph should have the key action as the y axis and the designated frequency as the x axis. This does not mean companies should ignore other measurements of satisfaction, but to understand definitively what product/market fit looks like, this is the best start.

This graph measures a group of users and how many of them perform the key action of your product over time. There will usually be a stark drop at the beginning, but for products with product/market fit, a percentage continue to find value consistently.

If you’ve been around startups long enough, you’ve undoubtedly seen startups with retention of customers that struggle to grow. If you’re not growing, you definitely do not have product/market fit. So product/market fit cannot be measured by retention alone. That retention has to create sustainable growth, which means the rate of retention matters. Why does the rate of retention matter? Well, most acquisitions of new customers come directly from retained customers through a few key acquisition loops. Either retained customers:

- talk about the product to others to attract them to the product

- invite people directly to the product to attract them to the product

- create content that they or the company can share to others to attract them to the product

- make the company enough money that the company can invest that money into paid acquisition or sales loops with a healthy payback period to attract them to the product

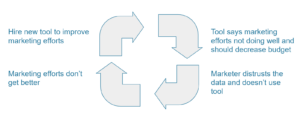

I’ve seen many founders misunderstand this, looking for growth hacks to drive growth or a PR bump. These types of tactics are only useful if they help you sequence to a sustainable growth strategy, but they rarely are sustainable growth strategies directly. This is why other measurements of satisfaction can still be important. If it doesn’t exist, the first two of these loops are impossible to drive growth from.

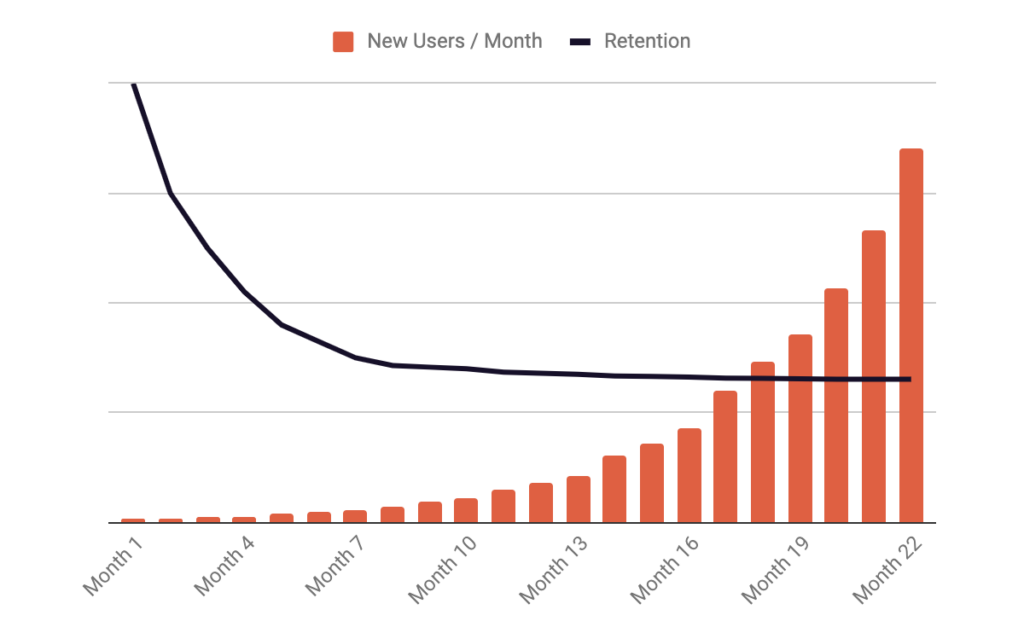

Sustainable growth is measured by one or more of these loops growing the size of your monthly acquisition cohorts month over month with a flattened retention curve. A flattened retention curve of your key action at the designated frequency plus month over month growth in new customers is the best way I have found to measure true product/market fit. If the rate of retention can’t support acquisition loops that continue to scale new users, retention needs to be improved to find product/market fit. Some companies can scale with 10% retained users, and some may need 40%, all depending on the strength of the acquisition loop. The graph below represents one month’s cohort retention over time vs. monthly growth in new users.

Consistent flattening of a month’s retention curve over time plus growth in new users every month is true product/market fit.

What if satisfaction of your product cannot be measured by retention? This happens. Some products are one time use or extremely infrequent in nature. In that case, I like to use custom surveys to measure the level of satisfaction depending on the nature of the product. Rahul Vohra describes the process they used at Superhuman for this, and it is excellent. Don’t forget to measure new user cohorts month over month though. Acquisition becomes even more important in these scenarios.

The Paths to Product/Market Fit

It takes most products a couple of years to find product/market fit. If you are not there yet by the above measurement framework, don’t be alarmed. The first step is to understand how far along you are and the approach to improve. There are two stages of the push toward product/market fit:

- Building enough of the product vision so that the product is valuable and ready for customers

- Getting customers to understand and receive the value you’re targeting for them

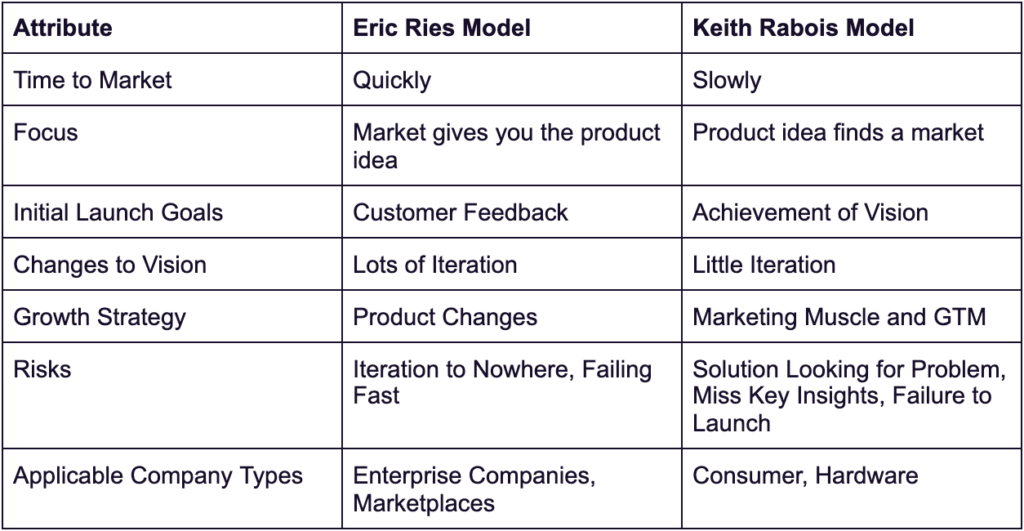

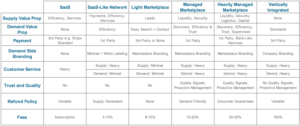

If you are in the first phase, you generally aren’t allowing customers to use the product anyway to measure product/market fit. There are two main schools of thought for how long you should stay in the first phase, which I will oversimplify into calling the Eric Ries model and the Keith Rabois model (unfair to both of them), and they are diametrically opposed on many axes including how long you build before you allow customer access. Thinking about these axes will help you understand what to do next and what successful companies did in this phase. I will outline some of the main differences below.

This is certainly oversimplified, but should help give an idea of the spectrum of things to consider with a new product. Let’s break these down in a little more detail.

Time To Market

The Ries model emphasizes talking to customers early and often to understand what to build, and whether what you have built is actually solving problems for them. The Rabois model is so driven by the vision of the founders of the company that customer feedback is less important than building what the founders have envisioned before any customers interact with it.

Success can be achieved by both modes. In the food delivery space, Tony Xu and the founders of Doordash and Arram Sabeti, the founder of Zerocater, famously used spreadsheets and founder manual labor to prove out their early models before investing in a lot of technology to scale. Shishir Mehrotra, the founder and CEO of Coda, spent four years building the product before any public launch, and now the company is growing quickly. In reality, companies that take longer to reach the market usually have alpha or beta customers that are still driving a feedback loop into the product. Coda used employees at Uber, for example.

Focus

The Ries model tends to target a customer segment and attempt to find out their pain points to build something valuable. The Rabois model starts with a strong vision of both a problem and a target solution and works to build that from the start. The Ries model is common in enterprise business where customers just want to deeply understand data scientists or general contractors or some other segment, identify a problem they deal with a product solution could solve, then build and test with that segment. Here, you’re more likely to see some early pivots as companies try out different solutions to the same problems or target different problems of the same type of customer. We incubated a few of these types of companies while I was at Greylock with success, but it was rarely the first iteration that was successful.

One issue with the Ries model here is successful product/market fit rarely avoids all speed bumps. Without a strong vision and motivation by the founders and being “in love with the problem”, those speed bumps can instead appear to be roadblocks causing companies to change direction too early, causing a lot of “failing fast”, which is just a more acceptable way to say failing. The Thumbtack founders are a good example of grinding through these moments and not giving up on eventual product/market fit.

Many founders with vision put out a product experience and eventually find a market interested in that product solution. TikTok and Houseparty didn’t initially set out to build a product for children. Clubhouse started blowing up in Atlanta, and its founders are both in Silicon Valley. Square and Faire, however, had pretty strong ideas of their initial target markets and did find product/market fit with those markets.

Initial Launch Goals

The only goal of launching a product in the Eric Ries model is to generate feedback from the target customer. These launches are generally limited in size to receive enough signal from the target customers to know if something is working or not. The goal of a launch in the Rabois model is to achieve the initial vision that sparked the creation of the product. Launches are usually broader in this model, because the product may be looking broadly for a market that will be attracted to the product solution being launched. Even if there is a strong thesis for a target market, launches are more likely to go big to try to reach the maximum amount of the market possible, because the product should be ready to provide them value day one. In network driven businesses, a bigger effort out the gate may be required to reach the liquidity necessary for people to experience the product/market fit. In marketplaces, this may be sequenced by targeting supply or demand first, but with direct network effects, it is more driven by volume. Twitter and foursquare both launched at SXSW to get initial liquidity correctly. At Grubhub, whenever launching a new market, we would target to sign up 50 restaurants in the first two weeks to have a good selection to show consumers.

Changes to Vision

The Eric Ries model is very flexible on vision, and companies on this side of the spectrum frequently pivot around customer needs quite a bit. Instagram, Twitter, Groupon, Slack, Pinterest, GOAT and many other successes started in one direction, and through either failure, seeing only part of their initial idea work, or fresh thinking altered their product and mission dramatically to find product/market fit. In the Rabois model, a singular vision drives the company from the start. Opendoor started with a mission to remake real estate through data science and instant sales, and has not strayed much from that vision.

I think this is an area where despite all the news we hear about successful pivots that leaning more towards the Rabois model is a dominant strategy. Blindly trying out a bunch of startup ideas is like being in a dark room and feeling around for a door. A successful vision can turn on a light to that room so everyone can see the door and run toward it. Even many of those major pivots were guided by a strong, albeit new, vision from their founders.

Growth Strategy

The Eric Ries model thinks about product change as the main way to unlock growth in the early stages. This requires a tight feedback loop between customers and the team so the team can tweak and adapt and potentially built totally new things to please potential customers. You’ll typically see these types of companies leverage growth hacks that are long-term unscalable, but could get the initial product to more people efficiently. The Rabois model implies product changes will be more difficult. The product vision is usually taxing, so relying on product change to grow is very expensive. Rabois prefers to leverage a strong go to market model and heavy marketing muscle to scale usage of the product. Neither of these models go particularly in depth on scalable growth loops, and of course I believe thinking in terms of the scalable loops you’re unlocking is a dominant strategy.

Building a successful product and company is like producing a movie. You have a script and vision first and film the movie. Then you sell tickets.

— Keith Rabois (@rabois) July 22, 2019

Risks

It’s weird to talk about failure modes in starting companies as most companies do fail. But there are tendencies of failure types in each model that founders should be familiar with as they are avoidable. The Eric Ries model tends to lead to either iteration to no eventual destination or a lot of “failing fast” that feels like progress and isn’t. We saw a lot of this with startup studios five or so years ago. I can’t recall one of them creating an enduring company. The Rabois model has entirely different risks. This is where you can find solutions looking for a problem, like many crypto pitches you hear these days (how many ICO’s found product/market fit? Is there even one?). Some memorable failures in this area in the past are Color Labs and Clinkle. These companies can spend so much effort selling what they have really hard without ever confirming people want it. Startups in this area can also become so consumed in their vision they fail to actually launch. Magic Leap is a recent example of this in the AR space. The Rabois model can also hide some of the key insights to unlock the market if not careful. Instagram and Pinterest only had a small part of their original visions work, so they pivoted to focus on just that element to build massive businesses.

Applicable Company Types

While these models can be used for any type of business, they tend to lean towards certain models. The Eric Ries model is very common in enterprise businesses because founders are confident certain segments have day-to-day problems that aren’t solved and money to pay to create a reliable business model, so they learn all about that segment to find that problem with the willingness to pay to solve. The quick to launch elements are common in marketplaces where matching can be done manually to validate liquidity before investing in a lot of technology. The Rabois model is more common for hardware because iteration has such long timelines, and consumer models where typically founders have new habits or interactions they need to convince a broad market to try.

So Which Should You Use?

Hopefully, you see from these examples that either extreme is pretty dangerous, and even those that vehemently believe in one of these models over the other seems to have selective memory as to when companies veered away from their approach when appropriate. Founders should build a strong opinion over which parts of which model they need to apply to maximize the chance of finding product/market fit for their business. My personal belief is a strong vision combined with market feedback is a pretty dominant combination of these two approaches whereas many of the other axes depend on the product you are building. I actually find both models fairly weak on the growth strategy side. “Sell tickets” ignores how the product is frequently the most effective way to unlock growth through strong acquisition loops. Assuming new products equals new growth is a “build it and they will come” fantasy unless you get lucky.

—

The reason to understand what product/market fit looks like is of course important for founders of companies. While measuring the product/market fit line directly is impossible, measuring whether a company is above it or not is possible by measuring retention curves and new user growth. If the retention curves every month flatten and new user numbers increase at a healthy payback period, you can feel confident you have product/market fit. If you can’t say this for your product, I hope I’ve been able to give you some axes to understand what you need to work on and how to apply it to your specific product. The next problem is to scale it and keep as customer expectations continue to grow. If you want to learn more about these concepts, we expand on them dramatically in the Reforge Product Strategy program.

Currently listening to my Scrambled Eggs playlist.

Thanks to Kevin Kwok and Emily Yuhas for feedback on drafts of this post.