As someone who has had a lot of success using SEO as a tactic to grow companies (for Apartments.com, Grubhub, and Pinterest it was the dominant channel for new users), I get asked a lot of questions about SEO as a strategy today. Andrew Chen’s Law of Shitty Clickthroughs states that all acquisition channels have a shelf life and decay over time. SEO has had by far the longest shelf life of any major internet channel. It has been a stable platform (unlike Facebook), it consistently grew itself, and it was supported by a very strong business model that could drive revenue growth for Google for well over a decade, so Google didn’t need to monetize all of the free traffic they distributed to other companies. Perhaps a more elegant way of explaining this is that since organic search exists to serve user needs, not advertiser needs, it was a more sustainable acquisition channel, precisely because it was not built to be a channel. People never wanted ads, more email, etc. like other acquisition channels. On Google organic search, people do want answers.

It’s this last statement remaining true amidst a platform shift to mobile that will mark the inevitable decline of SEO as a channel for user acquisition. Ben Thompson declared Peak Google a few years ago as a company. Why he was wrong then is why I am right today by declaring we are now past Peak Google as an acquisition channel. To understand this, you have to understand Google’s strategy. Google’s search engine is driven by optimizations that help its users. Ben Thompson does a good job explaining how this plays out with publishers. If you, like Google, have been analyzing its users for the last few years, you may have learned a few things. The first is that the majority of them are on mobile, where their time is more limited, their connections are (still) slower, and there is the threat of an app replacing frequent queries.

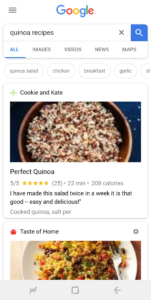

What Google is seeing is that their users no longer want to click ten blue links. They don’t have the time or the bandwidth, and there are now a plethora of competitors in the form of apps for many of those queries. The form factor is dictating the optimal user experience, and forcing Google to evolve. Users want an answer, and they want it immediately. So, that is what Google is doing. If you type a question into Google with a clear answer, there’s a good chance Google will just answer the question instead of recommending a site for it. We’ve all seen that. What’s more interesting is what Google is doing when there isn’t an answer, and the solution is to provide options, or what they would likely call a discovery experience. Recipes is a great example. Where you used to be treated to a bunch of “21 best recipes for X” pages, you now just see the recipes as results.

One would think these queries play perfectly into Google’s existing strategy of ten blue links. But Google knows consumers don’t want to click back and forth onto multiple sites to see each site’s recommendations. They want Google to surface up the options directly. And that is what Google is now doing. Take any top query category, and you will see Google replacing links with either answers or options showing up directly in search.

Whereas the top strategy historically for these “options” queries was to build an aggregator and rank at the top by having the most options, Google is now stating that it should be the only aggregator. In the same way Ben Thompson described the squeeze between Google’s demand for fast loading pages and banning of obtrusive ads on Chrome, Google’s search policies are doing the same for aggregators who do well on organic search.

How is Google doing this algorithmically? Google has started to seriously enforce two new policies over the last couple of years in their algorithm: internal search and doorway pages. For internal search, Google says:

Don’t let your internal search result pages be crawled by Google. Users dislike clicking a search engine result only to land on another search result page on your site.

Source

For doorway pages, Google says:

We have a long-standing view that doorway pages that are created solely for search engines can harm the quality of the user’s search experience.

Source

On the surface, these rooms seem sensible. If you continue to read to the end of the doorway pages update, you may start to see a problem:

- Is the purpose to optimize for search engines and funnel visitors into the actual usable or relevant portion of your site, or are they an integral part of your site’s user experience?

- Do the pages duplicate useful aggregations of items (locations, products, etc.) that already exist on the site for the purpose of capturing more search traffic?

- Do these pages exist as an “island?” Are they difficult or impossible to navigate to from other parts of your site? Are links to such pages from other pages within the site or network of sites created just for search engines?

Reading these two together, what Google is saying is that creating pages indexing your search result pages is a bad experience, and creating new pages that replicate your search experience in a different way for search engine visitors is a bad experience. These two rules effectively penalize any presentation of your inventory of content. How do they tell if these pages are created solely for search engines? It’s similar to how they are detecting bad ads: they use Chrome browser data. So, the guideline for an aggregator who would like to show their content to Google is simple: give us your content, and we’ll aggregate it, or play in the tiny space that is a non-internal search page and a non-doorway page. That effectively means creating a page with unique inventory that does not look like search, yet receives traffic to the page from other sources besides Google. There is a window there, but it is a small one.

While updating the algorithms for these rule changes, Google is figuring out how to be the aggregator in many categories now, and over the next ten years will go down the list of every top searched category and figure out exactly how to do that. To do this, Google will either build, buy, or partner with existing players. Let’s take a look at some of these examples.

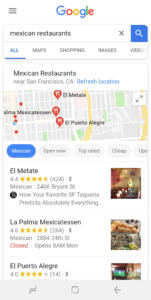

The Build Case: Google Local

Google tried to acquire Yelp to build local listings and relationships with local businesses. When Yelp refused, Google built out Google Local on top of Google Maps and Google Search, and now has direct relationships with thousands of businesses managing their information directly with Google. This was not very difficult when you have the dominant search product and the dominant maps product to build on top of. When you search a local query, you see no ads, just Google Local above all other search results.

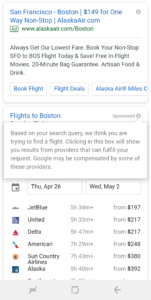

The Buy Case: Google Flights

In July of 2010, Google acquired ITA Software, forever depressing the market caps of many travel-related internet businesses. ITA powered flight search and pricing information for many top online travel agencies. As you might have guessed, that data now appears on Google directly for free. Google is monetizing that space, and looks to moving from a pay per click model to a more transactional model over time.

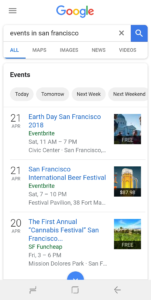

The Partner Case: Google Events

Late last year, Google launched a dedicated section when people search for events that aggregates events from third party sources, including Eventbrite. Third parties give their inventory to Google, and Google ranks the events on its own. You cannot rely on your business to be in this category. Google will likely partner if:

- There is no dominant player they can buy

- Supply is fragmented and data unstructured

- There are multiple companies willing to implement specific markup to appear in these discovery experiences

- The area is not one of the leading categories for monetization for Google today

What do you do if you’re affected?

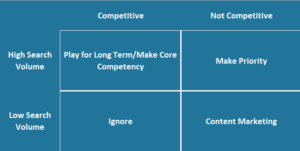

If you are an aggregator, and Google is moving into your space, it changes your SEO strategy entirely. Whereas you used to create and optimize pages that aggregate inventory for popular queries e.g. “san francisco food delivery” for Grubhub, those pages will now be de-valued as Google replaces those listings with its own aggregator. The best solution to this problem is to shift your strategy to distribution of your individual listings, so that you can outrank competition inside Google’s new discovery experiences. These pages usually need to updated to AMP formats, as that it what is powering all of these new discovery experiences inside Google search.

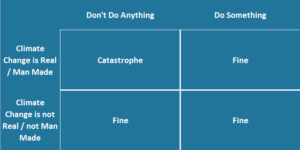

Many companies will attempt to opt out of this strategy, thinking it will help them preserve their current rankings if they delay or hurt Google’s ability to build a compelling, competitive aggregator to their own. This is unlikely to work. If there are any competitors to your aggregator, game theory will incentivize one of them to partner with Google to steal share. If you are a monopoly and opt out, it incentivizes Google to build a competitor that will threaten your monopoly, you will receive a lot less traffic that also threatens your monopoly in the interim, and Google can dedicate a lot of resources to a competitive product over many years. This appears to be working with Google Local vs. Yelp. Certain companies have been able to thrive despite these types of platform changes in the past by building loyal audiences with high switching costs, like Amazon with Amazon Prime when Google launched Google Shopping.

—

Google’s strategy has changed, though it will take years to propagate throughout every popular category of search queries. You can’t fault them for this change, as it is the right response to cater to their users. Right now is the right time to understand their strategy and to best position your company for its inevitable rollout. Gone are the days where you can rely on Google for a steady stream of free customers without putting in that much effort. You need to think strategically about where the company is going, if there are still opportunities where your content can attract Google visitors, and how you maximize the now declining opportunity.

Thanks to Randy Befumo for helping me through an early draft of this.

Currently listening to Challenge Me Foolish by μ-ziq.