I recently sat down in person with Brett Berson, partner at First Round Capital, to talk about marketplaces on First Round’s In Depth podcast. We cover a lot of different topics such as how to start marketplaces, what factors still matter in building marketplaces in 2024, how competition has shaped some of the biggest categories of marketplaces, as well as some common mistakes to avoid when scaling marketplaces. I hope you enjoy listening.

Tag Archives: marketplaces

Everything Marketplaces Podcast

I recently had a conversation with Everything Marketplaces where we went into a lot of topics around building and scaling marketplaces. Check it out below.

You can also view on Youtube or Apple.

Currently listening to my Future Jazz playlist.

The Best Way to Drive Demand in Marketplaces is Hiding in Plain Sight

This essay was co-created with Dan Hockenmaier.

In marketplace businesses, the network is the product. If you’re not growing both supply and demand, the product generally isn’t getting better over time. And your network effects which compound organic growth are not getting better, and probably getting worse.

Most marketplace founders and leaders intuit this over time, so they obsess over growth metrics. In this essay we explore one channel that helps many marketplaces scale faster than others: supply driving demand.

If a marketplace has the potential to use this channel and doesn’t, it leaves them unoptimized and susceptible to competition. But if they use it too much, it is no longer a classic marketplace and loses the compounding benefits of network effects. There is a Goldilocks Zone:

Driving between 10% and 40% of demand from supply is the Goldilocks zone to maximizing value of our a marketplace’s supply to grow demand. Obviously, other factors besides this determine the full value of a marketplace.

Exploring each case

Supply driving too much of demand (75-100%)

As Casey and Gilad Horev discussed in a previous essay, there are different types of marketplace models. In the SaaS-like network model, the supply is in charge of generating the majority of the demand, and the product acts as mainly a fulfillment or monetization vehicle for the supply. These products generally do not generate cross-side network effects. Because demand only comes to the product when supply tells them to, the product doesn’t feel materially better over time. Acquiring supply doesn’t get easier over time, because the product isn’t generating demand that supply has to come to the platform to access.

These models typically range from 75%-100% of their demand coming from supply, and include companies like Substack, Square, Eventbrite, Mindbody, and many others. Sure, they may generate some of their own demand over time, but not enough to unlock the types of cross-side network effects that power the best marketplaces to massive scale like Airbnb and Doordash. Generally, part of their strategy to grow is actually driving more demand that does NOT come from supply over time, and their value tends to come much more from how well the SaaS business can upsell new products over time.

The 50% threshold

Our rule of thumb is that a marketplace needs to generate at least 50% of the transactions for cross-side network effects to exist. If a supplier would get 50% more transactions through a platform vs. on their own, most rational suppliers would prefer that vs. the 15-25% higher margins they could get going directly to their customers and avoiding a marketplace fee.

This creates that attraction of supply to the product, decreasing acquisition costs. But it also means the selection for demand improves more quickly, making for better discovery, higher conversion, and generally higher frequency on the demand side. We see these elements in the best marketplace businesses. They have amazing cross-side network effects.

Supply driving very little demand (0-10%)

This isn’t ideal for the simple reason that supply driving demand is a great channel if you can get it to work. It is generally highly scalable (meaning its potential as a channel increases as supply grows) and relatively cheap (you are paying to incentivize your suppliers, which is generally cheaper than buying ads on Google or Facebook).

Can you build a great marketplace without supply driving demand? Of course. The company will just need other acquisition strategies they can leverage to be successful, such as virality, paid acquisition, sales, and user generated content, and they might need to spend more money to get to scale vs. marketplaces that can get demand side growth from supply.

The Goldilocks Zone (10-40%)

So, what is ideal? “Just right” appears to be driving your supply-led acquisition channel to north of 10% of demand, but less than about 40% where you start to see too much weakness in the company’s own demand drivers and resulting impact on its network effect.

(As an aside, the percentages in this essay should be thought of as transactions, not customers. If the suppliers are driving >50% of buyers in a marketplaces, but the marketplace is able to effectively cross-sell them to other suppliers on the marketplace such that transactions from this channel are <40%, that is likely just fine.)

At Grubhub, restaurants directly or indirectly drove about 30% of new demand-side acquisition at scale (and Doordash and Uber Eats have replicated this strategy to likely similar percentages). At Grubhub, we gave the restaurants a lower take rate for the orders they drove, but even so, restaurants driving customers to Grubhub became one of our most cost effective acquisition channels. At Faire, both sides of the marketplace refer their existing customers onto the platform because it is easier to manage orders with Faire’s free SaaS platform, and to get access to net 60 payment terms and free returns.

When to try it

Clearly not everyone can take advantage of this channel. Can you? It primarily boils down to three factors:

- Does supply have enough of their own demand and enough leverage over them to convince them to transact via the marketplace?

- Is supply sufficiently incentivized to do that via better fulfillment, lower costs, better tools, better data?

- Is that demand promiscuous enough where they value the access to other suppliers once on the marketplace?

Businesses like Grubhub, Faire, and Eventbrite have all three qualities. Uber and Airbnb are examples that fail on the first point. Most peer-to-peer marketplaces like Poshmark fail on the second because suppliers would much rather transact off platform via something like Venmo, Paypal, or Cash app to save fees. Upwork and Thumbtack fail on the third because once a buyer has a supplier they trust, they tend to stick with them.

If your business meets all three criteria and you’ve been banging your head against a wall on SEO or paid acquisition, using supply to drive demand is the first thing you should try.

Just don’t over-rotate. If you’re not careful you can accidentally pivot a marketplace business with cross-side network effects into a SaaS-like network that does not have cross-side network effects. You will then find you struggle with slower growth, generally lower take rates, and a weaker relationship with the demand side of the marketplace.

How to pull it off

Here are three things to focus on to enable this channel at scale.

1/ Make it clearly better for suppliers to transact through your marketplace vs. through other marketplaces or directly with their customers. Examples:

- Low or no fees for seller-referred transactions Examples: Faire Direct, Grubhub’s $1 fees for website ordering, Etsy Share & Save

- Better payment terms than offline transactions receive e.g. get money faster or pay slower Examples: Faire net 60 terms

- More efficient workflows when transactions are processed through the marketplaces that save the supplier time Examples: Eventbrite’s Mailchimp integration

- Take on financial risk for these transactions suppliers would need to manage on their own if processed outside the marketplace. Examples: Turo’s car insurance, Bounce BounceShield

2/ Create a referral incentive for supply that is meaningful but still hits your payback thresholds. Notes:

- Make sure to measure the value of seller-referred customers separately from other acquisition channels. They tend to be lower lifetime value due to the lower fees mentioned above and perhaps sub-par onboarding to the full marketplace value

- If this incentive is shared with demand, fraud detection is necessary to maintain effective payback periods over time

3/ Create marketing tools that make suppliers better at attracting more transactions. Marketplaces are generally more sophisticated marketers than suppliers at scale, and suppliers know this. Examples:

- Website builders or embedded checkouts into suppliers’ own websites that are better optimized for conversion. Examples: Eventbrite’s Embedded Checkout, Shopify Shop Pay

- Optimize supppliers’ Google Local presence. Examples: Grubhub, Bounce

- Email & SMS marketing tools. Examples: Eventbrite Email Campaigns, Zillow Contact Manager

- Pooled performance marketing data from all customers on people most likely to convert and tooling to more easily target them. Examples: Etsy Offsite Ads, Eventbrite Boost

If you can do these three things, you will be well on your way to creating one of the most powerful demand acquisition channels for marketplaces.

Be sure to subscribe to my Substack to catch future posts.

Currently listening to Casey’s 2023 playlist.

New Podcast with Lenny Rachitsky

I recently joined Lenny Rachitsky on his podcast for the second time. We covered a lot of interesting topics, such as why Grubhub ultimately lost to Doordash, over-reliance on frameworks and research in product management, and a deep dive on network effects, SaaS to marketplace transitions, and why consumer subscription is so hard. Listen on your favorite platform below.

Podcast Links

Currently Listening to Raven by Kelela.

Sequencing Business Models: The Types of Marketplaces

This is part two of a three part series on sequencing business models. This essay is a collaboration with Gilad Horev.

Casey’s first sequencing business models essay talked about the transition from a SaaS business model to marketplace business model, and why it’s so difficult. In this essay, we’ll go deeper into the gradients of marketplace models that a company can sequence to, and as a follow up, we will do the same for platforms. Models on this spectrum may seem similar to each other at first blush. Especially adjacent ones. But sequencing between models is always hard, and failing to appreciate the practical differences between them makes executing that transition even harder. If the previous essay was about the organization, this essay is more about the roadmap.

The Types of Marketplaces

If a company is thinking about sequencing into a marketplace, it’s important for it to understand that there are different types of marketplaces with different components. Having a good idea of what you’re sequencing to eventually is important, but also influences the transitions on how to get there.

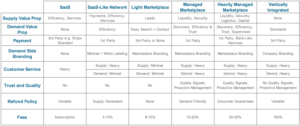

In Casey’s last essay, he covered the differences between regular SaaS companies and SaaS-like Networks. Building on the definitions from that essay and introducing a few new ones, here are the types of business models we’ll cover:

- SaaS: software that businesses access online and purchase via a subscription e.g. Slack, Adobe, Atlassian

- SaaS-like Network: any number of different models where a business sells software to businesses online and that software supports the interaction between the business customer and their end consumer. The business does not charge via a subscription, but rather fees are transactional or pre-revenue e.g. Square, Styleseat, Mindbody

- Light marketplace: a network model focused on transactions that happen without facilitation by the marketplace. There are two common modes here in lead gen and peer to peer e.g. Zillow, Thumbtack, Craigslist

- Managed marketplace: a network model that facilitates transactions between supply and demand by processing payments and ensuring quality of transaction by establishing trust e.g. Etsy, Ebay, Airbnb

- Heavily managed marketplace: a network model that facilitates transactions by participating in the delivery of the transaction in a meaningful way e.g. Uber, Amazon, Faire

- Vertically integrated: The company owns or directly employs the “supply” e.g. Clutter, Oyo, Honor

We find it’s best to describe these marketplace types against each other on some common vectors.

Common Marketplace Vectors

Click to view in more detail.

Before we examine these vectors, it’s important to understand there is no one dominant business model, and the larger companies grow, the more likely they are to sequence to new or additional models over time. Google, for example, has an ads business, a vertically integrated hardware business for the Pixel and Google Home, a developer platform in Google Play, an enterprise SaaS product in Google Cloud, consumer subscription with YouTube Music and YouTube TV, and many light marketplaces like Google Shopping and Google Flights. So, which model a company might want to sequence to next depends on quite a few factors.

Now, let’s examine these vectors to help understand, as one type of business model, what it means to sequence to another over time.

Supply Value Propositions

Let’s start with the most important thing. If a business is a marketplace, it is selling incremental demand to customers as its primary value proposition. A business is SaaS or SaaS-like if it sells anything else software-related. If a business starts as a marketplace, it usually means demand is the most important problem customers need to solve. If a business starts out SaaS or SaaS-like, it usually means its customers have ways of driving demand and have other important problems software can better help them with. It could also mean the marketplace dynamics needed to drive demand are very hard.

When a business starts out SaaS-like—solving problems that are more important to customers than demand generation—the most common problems it’s usually solving is payments. Early on, when Gilad joined Eventbrite, accepting payment and selling tickets online was still the biggest challenge for event creators. Unless you were a very large creator who could afford complicated and expensive enterprise software, you were likely stitching together a PayPal merchant account and a spreadsheet. It was common for PayPal to limit these merchant accounts because they didn’t understand the risk profile of events businesses, and for the ticket buyers to endure a pretty unpleasant purchase experience. Eventbrite offered a simple, vertical specific solution to the problem. Like Eventbrite, GoFundMe, Patreon, and Kickstarter were also all about accepting payments for services or raising money online. The difference between them and a pure software payments business like Stripe or Braintree is that they are self-service meaning they don’t require integration work or code, are vertical specific, and both sides of the transaction interact with the service. Other common value props that SaaS-like businesses address are around managing inventory or calendars. Regular SaaS companies that are not ‘SaaS-like’ have many different value props, but they typically exclude those above. Normal SaaS companies have no relationship with their customers’ customers.

As we move to the right of the business model spectrum, the sophistication of value props offered to supply increases. A light marketplace usually offers leads or connections and leaves it up to the supplier to then close the transaction. The marketplace doesn’t vouch for the demand in any way. It’s a bit of a free for all. A lot of people in the industry tend to feel like this is an old business model that goes away over time as the internet matures. We’re not sure. It depends on the willingness of the market to pay for a more sophisticated offering. When price is most important to customers, they sacrifice quality. Just look at airlines.

Moving further to the right, leads gets replaced as a value prop by liquidity. As opposed to creating leads, liquidity requires more of a focus on matching and that the marketplace does work to ensure supply attracts demand. In the more heavily managed version, the marketplace offers a lot more services to facilitate the relationship with demand. They may personally handle delivery like Doordash, take on financial risk to reduce friction of transactions like Faire, or provide loans to suppliers to help them invest in growing their business like Uber tried to do, or do multiple of these services like Shift. In vertically integrated models, the suppliers work for the company, so they don’t have to offer loans or reduce friction. They just own all aspects of the delivery of the product or service.

Demand Value Propositions

For demand, the value proposition landscape is a bit simpler. If I am a SaaS company, I have no relationship with demand, and therefore offer them no value prop. For a SaaS-like network, it’s really about making the transaction with the supplier as efficient as possible. So, a company like Solv or Styleseat may make the appointment booking process really smooth, or a company like Indiegogo may make the checkout process clean and simple. Moving further to the right, a light marketplace will invest in basic search and contact flows. Managed marketplaces up that game by including not only the efficient booking/transactional flows of the SaaS-like networks, but they offer better search plus other discovery mechanisms. Perhaps curations and algorithmic recommendations, notifications, emails, saved searches, etc. They also create signals to help consumers navigate to the best options through elements like ratings and reviews. More heavily managed marketplaces oversee fulfillment and delivery to make sure it happens to the demand side’s liking. Vertically integrated models have everything standardized, not just supervised, to make sure it is delivered to the company’s specifications.

Payments

This is one of the more tricky areas as depending on where the company wants to sequence to over time, it will make different decisions on how to handle payments. If the company only ever aspires to be SaaS or a light marketplace, it will probably not invest in its own 1st party payments products. But if it’s, say, a SaaS-like network on its way to being some sort of managed marketplace, it will not remove its payment infrastructure as it starts to offer light marketplace value props only to rebuild them when it shifts again to a managed model. Why do many of these models care about owning payments infrastructure? Well, the simple answer is they monetize it, but that’s not really it. Payments also allow the company to enforce policies that build trust in the marketplace. At Eventbrite for example, where tickets are typically purchased well ahead of fulfillment, some of the first primitive, but effective, fraud rules Gilad and his team put in place naturally relied on controlling when funds would be exchanged between demand and supply. Moreover, with additional control over payments, the company can offer more bank-like value propositions to customers in the future. Common forms of this are advancing payouts ahead of fulfillment, loans or a stored balance that can be used for purchases of goods or services.

Consumer Branding

SaaS companies that provide software to business have no relationship with the consumer of that business, and therefore, no branding to them. SaaS-like networks have a relationship with the consumer, but that consumer is not considered their customer. So branding is more minimal, and many of these companies allow white labeling of their software that can be embedded on their customers’ websites. Once a company is officially a marketplace, consumer branding takes prominence, and many of these models may not even allow white labeling as it would hurt awareness of the marketplace brand and the marketplace’s relationship with the demand side. Owning demand is one of the biggest predictors of marketplace success, so this is a big deal.

Customer Service

Customer service in SaaS businesses may take different forms. But it usually includes self-service components as well as some ability to get manual support. SaaS-like networks do the same, but tend to find the majority of customer service requests are from their customers’ customers, who they don’t feel responsible for. So they try to have minimal support there, and push that volume directly to the supplier. Even many marketplace models like Airbnb and Etsy try to push customer service directly to the supplier at scale because demand-side customer service requests are very costly. But since the marketplace owns the relationship with demand, it is tricky to pull off. A negative experience will be associated with the marketplace no matter what, like a bad rental on Airbnb or a bad ride on Uber. Casey certainly felt this at Grubhub.

Trust and Quality

SaaS models and even light marketplaces are more of a “free for all.” The consumer risks transacting with a poor supplier, and the company doesn’t guarantee the transaction. We’ve all had sketchy experiences on CraigsList, but we don’t expect them to step in and fix it for us. Once a company moves to a managed model, there is an expectation that the marketplace tells customers who is safe to transact with and gives a lot of detail as to what to expect. The marketplace should fire people on both the supply side and the demand side who cannot be trusted to create a quality transaction. Even early on, when Casey was at Grubhub, they fired restaurants who gave poor service, for example. Uber riders and drivers with low enough ratings will no longer be allowed to use the product as another example.

Refund Policy

This is another tricky one. SaaS-like models see the supplier as their customer and let the suppliers create their own refund policies. This creates confusion for consumers who don’t understand why they would get a different level of support from the company, based on which supplier they chose. Light marketplaces are usually caveat emptor. Managed marketplaces, because they care about owning the demand, usually have very demand-side friendly refund policies and enforce a standard that supply must comply with to continue transacting on the marketplace. Heavily managed marketplaces usually have demand-side guarantees.

Fees

The broader trend you might have noticed is the further right a company goes, the more in general it is doing to manage the business. The only way to make this work is by charging more in fees. Different companies approach this differently, and will have their own mix of transactional fees vs. subscription fees, and vary in terms of how much is paid by supply vs. demand. But there is no way to move to the right of this spectrum without making more in the process to finance all of the extra services. The challenge some companies face when they want to move to the right is there is no extra money to be made from supply or demand to make that move profitable.

—

We hope this helps people building marketplaces understand the different styles of marketplaces out there and what that tends to mean for what a company has to build to be successful in them. Not understanding the spectrum of models means that companies can build the wrong things in the wrong order, preventing them from sequencing effectively. The same is true for platforms, which we will discuss in the next essay.

Currently listening to A View of U by Machinedrum.

What Is Good Retention: An Exhaustive Benchmark Study with Lenny Rachitsky

At the end of 2019, I presented Eventbrite’s product plans to the board for 2020. These plans included a lot of the goals you likely have in your company: improvements in acquisition, activation, and retention. One of our board members asked: “I understand these goals for the year. But long term, how high could we push this retention number? What would great retention be for Eventbrite?”

I actually didn’t have a great answer. Soon after, I was chatting with Lenny Rachitsky, and we decided to embark on a holistic study across the industry to ask “what is great retention?” across business models, customer types, etc. Lenny surveyed a lot of the top practitioners in the industry across a variety of companies, and we’re happy to share the results here. You can see the raw data below, but I recommend reading Lenny’s analysis here. Done? Good.

Why is retention so damn important?

Why are Lenny and I spending so much time researching retention? Because it is the single most important factor in product success. Retention is not only the primary measure of product value and product/market fit for most businesses; it is also the biggest driver of monetization and acquisition as well.

We typically think of monetization as the lifetime value formula, which is how long a user is active along with revenue per active user. Retention has the most impact on how many users are active and lengthens the amount of time they are active. For acquisition, retention is the enabler of the best acquisition strategies. For virality or word of mouth, for example, one of the key factors in any virality formula is how many people can talk about or share your product. The more retained users, the more potential sharers. For content, the more retained users, the more content, the more that content be shared or discovered to attract more users. For paid acquisition or sales, the more retained users, the higher lifetime value, the more you can spend on paid acquisition or sales and still have a comfortable payback period. Retention really is growth’s triple word score.

What are effective ways to increase retention?

Okay, so you understand retention is important and want to improve it. What do you do? Well, at a high level, there are three types of efforts you can pursue to increase retention:

- Make the product more valuable: Every product is a bundle of features, and your product may be missing features that get more marginal users to retain better. This is a journey for feature/product fit.

- Connect users better to the value of the product that already exists: This is the purpose of a growth team leveraging tactics like onboarding, emails and notifications, and reducing friction in the product where it’s too complex and adding friction when it’s required to connect people to the value.

- Create a new product: Struggling to retain users at all? You likely don’t have product/market fit and may need to pivot to a new product.

We discuss these strategies in a lot more depth in the upcoming Product Strategy program coming soon from Reforge, and if you really want a deep dive on retention, we build the Retention & Engagement deep dive.

Why does retention differ so much across categories?

One question you might be asking yourself is why does retention differ so much by different categories? This was the impetus for the initial research, and why I couldn’t give a great answer to our board. Every company has a bunch of different factors that impact retention:

- Customer type: For example, small businesses fail at a much higher rate than enterprise businesses, so businesses that target small businesses will almost always have lower retention.* This does not make them inferior businesses! They also have many more customers they can acquire.

- Customer variability: Products that have many different types of customers will typically have lower retention than products that hone in on one type of customer very well.

- Revenue model: How much money you ask from customers and how can play a big role in retention. For example, a customer may be more likely to retain for a product they marginally like if it costs $30 vs. $300,000. A product that expands revenue per user over time can have lower retention than ones that have a fixed price.

- Natural frequency: Many products have different natural frequencies. For example, you may only look for a place to live once every few years (like my time at Apartments.com), but you look for something to eat multiple times of day (like my time at Grubhub).

- Acquisition strategy: The way a company acquires users affects its retention. A wide spread approach to new users may retain worse than carefully targeting users to bring to your product.

- Network effects: Network effects may drive retention rates up more over time vs. businesses that do not have these effects. For example, all of your friends on Facebook or all of your co-workers on Slack makes it hard to churn from either product whereas churning from Calm or Grammarly is entirely up to you.

* In those businesses, the business failing and churning as a result is called “involuntary churn”, though that can also mean a payment method not working for someone who wants to retain in other models.

BONUS: Why are Casey’s benchmarks for consumer transactional businesses lower than others?

For the demand side of transactional businesses, where the retention graph flattens is more important to me than the six month retention rate. And unlike other models, these businesses can take longer than six months to have their graphs flatten. Also, for marketplaces, one of the two common models along with ecommerce in this category, a healthy demand side retention rate is very dependent on what supply side retention looks like and acquisition costs. For example, since Uber and Lyft have to spend so much time and money acquiring drivers due to a low retention rate, in order for their model to work, demand side retention either has to be high or demand side acquisition has to be low cost. For a business where supply side retention is high and acquisition costs are low, demand side retention can be lower, and the company can still be very successful. Etsy and Wag I imagine fit more into this model.

Currently listening to We All Have An Impact by Boreal Massif.

Sequencing Business Models: Can That SAAS Business Turn Into a Marketplace?

As someone who has spent a lot of time building marketplaces in my career, a curious thing has happened over the last couple years. Founders have started reaching out asking for help converting their SAAS or SAAS-like business into a marketplace. The approach sounds a bit like this:

- I’ve amassed a large group of X type of professionals

- I’ve helped their business, but they’re asking for help driving more customers

- Since I already have the supply, it should be easy to build the demand side to have a successful marketplace

- My customers will be happy, retain better, and I’ll be able to charge them more

So goes the story. Now, this story itself explains why many businesses fail to make the conversion to marketplace. If driving more customers was your customers’ #1 need, and that’s not what you helped them with, you probably didn’t build a very successful business, or the problem of solving customer acquisition for that market is very difficult.

What Types of Businesses Are We Talking About?

Before we go any further, we should talk about what these businesses look like, and what they mean when they ask about becoming a marketplace. Many of the terms we use to define businesses today are features of the business rather than an encompassing definition, like the words SAAS or platform, which makes them not very useful. Note: I am blatantly stealing Brandon Chu’s platform definitions for this. Let’s break down these definitions so we know where we’re at:

- SAAS: software that businesses access online and purchase via a subscription e.g. Slack, Adobe, Atlassian

- SAAS-like: any number of different models where a business sells software to businesses online, but does not charge via a subscription e.g. transactional or pre-revenue

- Marketplace: a business where sellers (frequently businesses) provide their services on a platform to attract additional buyers, and buyers come to this marketplace to seek out these services and find new suppliers. Marketplaces commonly process the transaction and charge a commission to either the supplier or the demander. If not, they usually charge some sort of lead generation fee to the supplier.

- Developer platform: a business where developers can build businesses on top of the business’s software and charge customers. The end customer is usually not aware this company even exists e.g. Stripe, Twilio, Amazon Web Services

- Extension platform: a business that enables other developers to make your product better where the platform owns the relationship with the customer and provides some of the direct value itself e.g. Shopify, WordPress, Salesforce

- Networks: a type of platform where consumers interact with each other and/or content on the platform in a non-transactional way e.g. LinkedIn, Pinterest, Yelp

So, when we talk about businesses trying to become marketplaces, what we’re talking about usually is sellers of software to businesses trying to help those same businesses attract more buyers by aggregating buyers on their platform and aiding in the discovery of those buyers finding the businesses the company currently counts as customers.

The Weak Transition to Marketplace Arguments

Why is there a sudden demand of founders looking at this strategy? There are three fairly weak arguments I don’t like, but I’ll present them anyway.

#1 Saturated Growth in SAAS

Perhaps it is a natural extension of the SAAS explosion the last ten years. Kevin Kwok and I have often discussed that growth at some scale equals an adjacent business model:

- Ecommerce businesses trend towards marketplaces over time e.g. Amazon

- Marketplaces trend towards vertical integration over time e.g. Zillow

- SAAS businesses trend towards extension platforms e.g. Salesforce

Perhaps as SAAS has moved into more niche verticals, the extension platform opportunities have dried up, so companies are looking at consumer marketplaces as a new potential growth lever. But SAAS companies continue to grow on the public markets. Perhaps as SAAS has expanded into industries where customer acquisition is difficult, they’ve found their businesses at best only solve the second most important problem for their customers.

#2 Desire for Market Networks

Perhaps it’s because of James Currier. He has blogged repeatedly about market networks being the companies of the future. These companies combine SAAS, marketplaces, and networks. But these founders are not using this term, and this supposed revolution looks no closer to happening five years after his original prediction. Some businesses attempting to build out market networks have become good SAAS businesses e.g. Outdoorsy with its Wheelbase product, but there is no evidence they’ve actually ended up building marketplaces or market networks. Honeybook has struggled, and Angellist and Houzz started as networks, not SAAS businesses. Angellist has never added a SAAS component. Houzz acquired IvyMark last year to launch a SAAS model after ecommerce, ads, and marketplace models for monetization disappointed, and it is too early to understand how well that is working. All evidence shows that if market networks are real, they are more likely to become them from starting as a marketplace or network first, then adding SAAS, not the other way around. Faire is a recent example of this.

#3 It Worked for OpenTable

Now this is a reason I actually hear. But it’s not a great one. The first reason is that OpenTable was a marketplace from day one. Customer acquisition was always a key value proposition, and they delivered on it. It wasn’t aspirational. Second, OpenTable is one of the largest public market disappointments of the last ten years. With an infinitely sized market, the company struggled, was acquired, and then written down significantly post-acquisition by Booking.com.

While these stories exist and do influence some founders, I do still think the main reason why is illustrated in the initial story above; it’s just the strange allure of ongoing customer development.

Why Changing Business Models and Customers is Always Hard

Ignoring the impetus for the rapid increase in desire for SAAS businesses to transform into marketplaces, let’s talk about why companies struggle to do this in practice, and how you fight these headwinds. Through my research and directly working with companies attempting these changes, I’ve identified some main barriers for this transition. If you can work through these barriers, your chances of making this mythical transition increase dramatically.

#1 Founders have to change the incentive structure for all or a significant percentage of the company

SAAS or SAAS-like businesses can grow very quickly. If you’ve spent a significant amount of years building a SAAS business and are considering the marketplace transition to drive additional growth and value to your customers, you’ve almost assuredly built a significantly large base of customers, still have growth targets on this core business, and are managing a lot of complexity already. What happens frequently is founders attempt to spin up a team to work on what’s usually a large, new addition to their current product offering. This initiative is considered a long term, strategic play. It’s important, but not urgent.

What happens to important, but not urgent, initiatives at fast growing companies? They usually get broken up by other important, but more urgent initiatives for the core business. Oh, our quarter was soft, and we need more resources to get back on track? Take them from the marketplace team. We’ll get back to it later. Have an initiative that could drive additional growth in the core business, but don’t have the resources? Take them from the marketplace team. We’ll get back to it later. And so on.

It’s always more attractive to take the more guaranteed optimization on the core business than risk those resources for the very long term, completely risky proposition that might drive a step change in growth for the business much later.

Fortunately, this issue is not new to fast growing companies, and there is a solution. In fact, we faced this very issue at Pinterest. Our largest strategic issue was international growth, but employees kept optimizing 1-2% changes in the U.S. business that moved the top line instead of international work that needed to begin from scratch. Founders usually have two tools to solve this problem. The first is to make the entire company’s growth revolve around this new initiative. That’s what Ben Silbermann did at Pinterest. The entire company was goaled on international growth at the expense of U.S. growth. And it worked.

The other tool is what usually happens at larger companies looking to expand into new product lines. They create a new team with separate goals and reporting lines. Frequently, they don’t even sit in the same building. This is what we did at Eventbrite. We created a Marketplace business unit with a GM reporting directly to the CEO. And while they sat in the same building, it had its own team and its own OKRs.

Changing the goals or creating an independent team with its own set of OKRs does not guarantee marketplace success, but they free you from the temptation of dismantling or impacting teams that frequently need to do years’ worth of work to find product/market fit for a second set of customers.

#2 Founders have to shepherd the right new and existing resources most likely to value the business model transition and change the company culture

Strong businesses usually build a culture of understanding their customers and their model very well and catering to those needs. What happens when you suddenly ask those employees to care about a second customer, or a new business model, and potentially trade off the needs? Old habits die hard. Employees still default to doing what’s best for the current customer/business model even at the expense of the new customer. And even if they do want to care about the new type of customer, they may not have the DNA. Consumer and B2B cultures tend to be very different, for example, attract different types of talent, and there are very few people who are great at both.

Building B2B products can be very different from building consumer products, and many marketplaces (but not all) have consumers on the demand side. In this case, your customer is a less reliable narrator for their needs, so user research, while effective at identifying their problems, can be a lot less reliable at predicting what people will actually use. Consumer products require significantly more experimentation, and have the data to do it because there are so many more consumers than businesses.

This cultural issue frequently requires new blood in the organization and careful recruitment of internal resources that are more passionate about the opportunity and usually have some background in consumer product development. Usually, leaders are brought in to lead teams like this with heavy consumer backgrounds, and they recruit more new people with consumer backgrounds. The use of advisors with that kind of experience (like myself) is also common—to suggest product development best practices that may be better suited for the task, to prevent common marketplace-building mistakes, and to more objectively monitor if progress is occurring at the appropriate rate.

How to Be Better Positioned to Build a Marketplace

While transitioning to new customers and/or business models and described above is hard, there are a few ways to make the transition to a marketplace more likely to be successful from a SAAS-like business.

#1 Founders need to confirm there is a demand side to this market, and the way you would engage with them aligns to you and your customers’ business models

One major reason marketplace transitions fail is that there isn’t actually a demand side to this theoretical marketplace to be added. These companies are selling to the supply side of a theoretical marketplace, and don’t understand if demand exists. There are two shades of this I have seen. One is that the SAAS customers make their revenue not by selling something people want to buy and find more, but that people feel compelled to support financially. Let’s take GoFundMe or Patreon as an example. These companies would love to have consumers come to their websites and find people and causes to support. Patreon even tried this. But are consumers searching for websites where they can donate more of their money to artists and local causes? No, not really. Do they support artists and local causes? Of course, that’s why those businesses have done well. But consumers generally aren’t searching for more causes.

The second shade is that the marketplace opportunity is only to find a vendor once on the demand side. In these markets, once a consumer finds a provider for a service, they tend to stick with them for long periods of time. Let’s say you are looking for a babysitter. If you find one that works for you, you stick with that person for a long time. This is in contrast to ordering food, where variety is a feature, not a bug, of the decision-making process. While successful marketplaces have been built in these areas, they are harder to build. SAAS companies struggle to transition in these markets because they have to build trust signals that may damage their relationships with their clients, and there are generally better platforms for researching these vendors than on the SAAS platform e.g. Yelp for local restaurants and services, Tripadvisor for hotels, and G2 Crowd for software. Also, how should the SAAS tool price these additional customers? Just once for the acquisition, or every time they use the product in the future? The clients and the company will usually be misaligned on this, creating leakage. In this case, the business model for the marketplace doesn’t align with the business model for the SAAS business or the SAAS customer. In a weird way, by trying to address the biggest problem you heard from your customers, you built a product that doesn’t work for that need, but for your own.

Again, this is a solvable issue. It can be mitigated through a lot of customer research on the demand side. Not only understanding the consumer your clients are targeting, but finding a critical pain point for them that isn’t solved on the market by another product that your company can actually solve due to its relationships with all of the suppliers in the market. Then, try to align revenue to the value you create in a way your SAAS customers will understand. And be prepared not to capture all of the value.

#2 Make sure the opportunity actually aligns to the characteristics of other successful marketplaces

Transitioning to a marketplace effectively requires founders to understand what makes a successful marketplace, and those characteristics are surprisingly opaque to people who haven’t worked on marketplaces. Rather than reinvent the wheel, I encourage founders to read Bill Gurley’s treatise on 10 factors to consider for marketplaces. One other factor Bill neglects to mention that is important is that normally marketplaces are built on top of under-utilized fixed assets:

- Excess kitchen space for Grubhub

- Idle cars for Uber/Lyft and Getaround/Turo

- Empty bedrooms for Airbnb

- Empty land for Hipcamp

- Empty hotel rooms for Booking.com/Expedia

- Excess SMB Inventory for Groupon

Do your current customers have this characteristic?

Can the Transition to Marketplace Ever Work?

It’s clear that evolving a SAAS business to a marketplace is an emerging strategy that more and more founders will research. What is important is to make sure you’re doing it for the right reasons, and that you’re prepared to fight the main barriers that prevent this transition from working. It’s also important to remember that even if you fight these barriers, this transition takes time. Marketplaces tend to take 2-3 years to find product/market fit. You need to be in a position where you can invest for that long before seeing a return.

In the Advanced Growth Strategy course, Kevin and I talk a lot about minimum scope. Minimum scope is the activation energy that makes a strategy viable. In the course, we talk about the minimum scope for cross side network effects to emerge. And in our examples, we do show that most cross side networks (but not all) emerge with the supply side first. But you have to remember that you do have to hit minimum scope for the demand side as well. And many businesses find they do not have a good answer for this.

Another existential issue for founders looking at this transition is that it inverts the typical company building model. When building a company (especially if you are raising venture), you typically have different assumptions you have to validate to receive funding rounds and eventually build a successful, long-term business. The harder the assumption you validate, the more likely you are to be successful, and the easier a fund raise will be. Ask any founder whether building a SAAS business or a marketplace business is harder. I bet you almost all will answer that a marketplace is harder. With the SAAS to marketplace strategy, you defer the hardest part of your strategy.

When looking for inspiration, it’s true there isn’t a cohort of companies to emulate, and that’s scary. In fact, almost every other business model transition related to this has more data to support. Flexport started as a SAAS business from the demand side (called ImportGenius), and built a marketplace on top of it, for example. Almost all marketplaces add a SAAS component eventually to their model. But don’t be too scared if this is your strategy. If you can answer positively:

- Can I change the culture?

- Can I change the structure?

- Have I vetted a demand side exists?

- Does the demand side actually exhibit great marketplace characteristics?

Then you are off to a great start in building a new scalable model of growth for your business.

Have transition to marketplace questions? If so, hit me up in the comments.

Thanks to Kevin Kwok and Gemma Pollard for giving feedback on this post. Also thanks for Brandon Chu for letting me use his platform definitions.

Currently listening to my 2010s Shortlist playlist.

Centralization Vs. Decentralization in Marketplaces and Scaling Companies

First off, no, this is not a post about blockchain. Sorry to disappoint you. This is a post about structuring your teams, and structuring your business. A common problem I work with entrepreneurs on is where power should be held both inside and outside organizations. These entrepreneurs have heard the stories of how instrumental Uber’s local teams were in their success. They have also heard about marketplaces that have given all of the power to the supply, and also marketplaces where supply has no power. They struggle to understand for their particular business, how much power am I centralizing in HQ, or how much power am I centralizing inside the company vs. outside it.

These issues usually arise in two areas, which particularly, but not exclusively, affect marketplaces. One is around local expansion. When I enter a city or country, who is in charge of that market’s success? Is it a local GM or someone in HQ? The same questions emerge for satellite development offices and going international. Do I hire local managers? Or do people report into managers in HQ? Who owns a country’s growth? The second issue is around who controls the quality of the service. Do we let the supply side determine their level of service, or do we standardize it across all of our supply? Is there value in standardization or variety of service level?

Advice on these topics usually misses the main factors a company should be considering when making these decisions. That main factor is where does the expertise lie, and what enables the best execution. And both of these can change over time. Uber is a great example. Because of training and car inspections, supply side onboarding had to be decentralized to a GM in each market. And because each market needs to boot from scratch, it generally made sense to give the GM responsibility for the entire market. They could do scrappy things to drive supply and demand acquisition and brute force initial liquidity. Once Uber had initial liquidity in these markets though, it ran into decentralization problems. Uber started to build up world class acquisition teams in HQ that didn’t have full control on how to scale customer acquisition. Local teams were still doing scrappy tests that didn’t scale, and not managing budgets as efficiently. Uber eventually centralized a lot of this work, but most people will probably tell you they did it too late, causing a lot of political strife.

On level of service, however, Uber has always strictly standardized their level of service across markets. Uber is not interested in drivers creating their own style of service. Consistency is a key part of Uber’s offering to passengers. Uber decides if they want to introduce varying levels of service in markets in a standardized way, with Black, X, Pool, etc.

At Grubhub, we started with local responsibility for supply with outside salespeople and HQ (read: me) responsible for demand. The playbooks my team developed to drive demand with SEO, SEM, and offline marketing scaled equally well to new markets as long as we reached enough supply. For supply, we had to build knowledge of the local market, and the best way to do that was boots on the ground. Over time, as we refined our process to determine quality restaurant leads and which neighborhoods mattered, we started centralizing supply with an inside sales team in HQ as well. For market launches, we would paratroop salespeople into a market to get to a certain amount of liquidity, then retreat to inside sales to scale.

For level of service, variety matters a lot for a business like Grubhub because not everyone wants to order the same type of food. There is also demand across different price points, time of day, day of week, etc. Variability in the food from restaurant to restaurant is a feature, not a bug. Grubhub uses ratings from the demand side to determine if a restaurant is below a certain floor of quality it is willing to accept, and if it drops below that, they will remove the restaurant from the service. Where Grubhub has standardized more over time is the delivery experience. Grubhub used to outsource 100% of its deliveries to the restaurant, and now over 20% of orders are delivered by Grubhub couriers. I previously explored the variables in the food delivery space here.

Airbnb has evolved similar to Grubhub. At first, Airbnb let hosts define their level of service and encouraged them to express themselves and figure out their own pricing. As Airbnb grew, it developed a deeper understanding of what Airbnb guests want and what prices will be successful. It is now standardizing those pricing levels and amenities hosts are expected to give. Now, they are not booting hosts off the platform who choose not to adopt these strategies. Instead, they are promoting more aggressively the hosts who have specific designations (at first Instant Book and now Airbnb Plus) with higher rankings in search results and special filters. They expect most hosts will conform over time due to these incentives.

It is unclear if this is the right strategy for Airbnb. While baseline expectations for service are a good thing in hospitality, there is a possibility the service could lose some of the uniqueness that partially made it desirable as an alternative to hotels in the first place. Airbnb’s value propositions that made them grow so quickly were lower cost and more unique inventory (both more unique places to stay as well as in more unique locations like local neighborhoods). It will be interesting to see how professionalizing supply works for them in the long term.

Eventbrite is an interesting example of approaching decentralization. Eventbrite works with event creators, commonly known as promoters. What do event promoters know how to do: promote their event! So Eventbrite partially outsourced demand acquisition to its supply of event creators. Event creators knew how to attract ticket buyers better than Eventbrite did in many cases. As Eventbrite has grown though, it has gotten significantly better at helping event creators sell more tickets. It now has proprietary distribution channels the event creators do not have like its app and website, a strong SEO presence, and distribution partnerships.

Eventbrite also has development offices in many different countries now. When you hire a PM for a particular business unit, do they report to the local office leader, who may not have a product background, but knows what is going on in the office really well and knows how to hire locally? Or does the PM report to a product leader that may not even live in the same country but knows how to develop product managers and understands the product strategy? This was a recent problem we worked on. What we decided is that the PM would have a local leader that is in charge of making sure that PM is a happy and productive member of that local office and a functional leader that is in charge of making sure that PM is a happy and productive member of the business unit and product team.

General Best Practices

Out of these examples some best practices emerge. If you’re thinking about these questions for your business, I would ask the following questions:

Am I launching a new market? If so, how much of a replicable playbook do I have on how to launch successfully?

The earlier the stage of the market you are expanding into and the less of a playbook you have for this, the more likely you want a local owner in charge of figuring out how to make the market work. Their job, however, is not to own the market long term. It is to get to liquidity as fast as possible so that subject matter experts in HQ can take over parts of the growth of the market.

If you have a refined playbook like Grubhub eventually did, you may find you don’t need local expertise for supply or demand.

Once a market has launched, who is in charge of the growth of the market?

Once a market has found liquidity, or product/market fit, it depends on how much of what drives that market’s success is shared with the rest of the company. If the market is fairly unique, a GM with control may make sense. However, most markets have a fairly similar growth playbook once the market finds liquidity. Usually, this means, if a GM exists, they should not own the growth of the market. Instead, they control growth levers that cannot be managed effectively from HQ, such as training and local partnerships and local feedback to HQ teams. They also frequently are an execution layer for HQ strategies such a PR, content marketing, etc. A lot of companies make the mistake of keeping the onus of growth on a local person even after it is revealed most of the levers for growth are controlled by HQ, creating a very frustrating role for that GM.

Is supply variability a feature or a bug?

Does the demand side of your marketplace have homogeneous needs? If so, can you standardize that into different products or not? If not, you will allow your supply more control over what services they provide until needs become more homogenized or are cleanly separated into different products that can be standardized.

Who manages local team members?

If they are operations focused on local needs, they are usually best managed by some sort of operational team. At Pinterest, these team members were managed by a Head of International in HQ. At Grubhub, since all of our local people were salespeople, they were managed by a VP of Sales in HQ. If, however, you have local development teams, those teams have different management needs that typically need to be managed by different people. They need a functional manager that can tie them into the HQ’s strategy. Because of the size of the team though, they also need a local manager that can recruit them and make sure they are a happy and effective local employee that an HQ manager won’t have visibility into. As teams scale, they usually add local management layers that report into functional managers in HQ. For product, for example, that might be a Product Lead in a satellite office reporting into a Director or VP of Product in HQ. If you don’t have enough product managers to have a local manager, they usually dually report into the HQ Head of Product and the satellite office manager.

—

Most companies centralize decision-making over time in their main office. They do this not because they are hungry for control, but because they start to build up more expertise than either their local offices or their suppliers. It is not actually the leadership team centralizing the decision-making, but the subject matter experts in HQ. The real question to ask when you are managing these problems yourself is where is the expertise for this problem, and is it changing, and how does execution need to occur for this problem.

The Problems With Martech, and Why Martech is Actually for Engineers

Since I spent some time in VC land and have a background in marketing, a lot of people ask me about martech, or technology built for the marketers. Are these good businesses? Which tools should they use/are on the rise?

In short, I hate martech, and think martech will decline as a category, and most martech businesses will not be very successful. I think there are a few reasons for this that are not well understood, but if you understand them, it can unlock some martech opportunities that are still quite large for entrepreneurs, and help marketers understand which technologies to bet on vs. bring in house. The main misunderstanding is that successful martech is actually for engineers, not marketers. Let’s talk about why that’s the case.

Martech is a Response to Engineering Constraints

A controversial opinion I have stated before is that the marketing function in technology companies is usually a response to engineering constraints. If you don’t have enough engineers to build a system to manage bidding for performance marketing, you hire a marketer. If you don’t have engineers that can work on SEO, you hire a marketer. If you can’t build a great email system, you hire a marketer. Most key marketing roles are manual tasks that can better be solved with engineering. The smartest marketers, realizing this, started automating a lot of their work through third party tools, and if they could, even better, first party tools. This is how martech exploded over the last decade. Marketers actually had important, if not critically under-weighted, responsibilities for the company. For example, I was in charge of getting new people to try ordering online at Grubhub, and to keep them coming back once they did. My team used a lot of martech tools to do that.

Engineering Constraints Are Being Laxed

While hiring engineers inside companies to solve these problems is still extremely competitive, engineering constraints are (slowly) being laxed across every technology company I meet. Startups and technology companies today have many more engineers working on more functions (due to improvements on engineering technology) than we had at Grubhub during similar stages of our company.

These engineering constraints being laxed means martech companies have to compete with the engineers at the company for the best way to solve a marketing problem. And besides there being more engineers in a company to work on these problems, engineers are now more likely to want to work on these problems or reject these tools as best practices. Growth teams have emerged to work on a lot of the traditional marketing problems marketing teams bought software for: email, SEO, landing page optimization, onboarding, etc.

Martech now finds itself in a more competitive environment since “build” in the “build or buy” equation is more likely than it used to be. Also, if engineers inside a company do decide to build instead of buy a solution, a lot of times what they build is more effective than what the martech provider can offer. This is not to say engineers inside tech companies are better than engineers inside martech companies; engineers inside tech companies simply have unfair advantages. Not only can engineers building the solution for their company build directly to the needs of their company instead of adapt some generic solution; they can also more easily integrate with the data needed for these tools to make the right decisions. It is notoriously difficult, for example, for many martech tools to integrate conversion data, and certainly much harder for lifetime value data. This is much more easily done with an in-house built tool.

Platforms Also Limit Martech’s Reach

Martech companies face the squeeze from the other side of the integration as well. Usually, martech companies integrate into some other system: advertising companies like Google and Facebook, adtech companies like exchanges and demand side platforms, email service providers and email clients, etc. What happened is these martech companies built value added features on top of a platform to deliver extra value to customers. What is happening now is those platforms are either integrating those best features themselves, so you don’t need the martech company for it anymore, or deleting the access that enables it, because the platform doesn’t actually want that level of transparency.

Where Can Martech Be Successful?

So these companies have the platforms stealing their features or cutting off the access that makes them possible on one side, and engineers at the companies of their clients building deeper integrations themselves. So, if most martech solutions have a disadvantage to competing with in-house engineering solutions, or the platforms starts competing with them, what type of martech tools have an advantage?

Option 1: Leverage Data Network Effects

One key example where martech thrives is when the external data becomes more important than the internal data. If a martech tool can be gathering data from multiple companies, and create a data network effect from this aggregation, thereby helping all companies improve in a way they could not on their own, they are very defensible. Sift Science is a great example of this. By being used as a fraud provider across thousands of companies, they have data any individual company won’t have in determining if a transaction is fraudulent or not.

Option 2: Manage Pain

Similarly, integrations with a bunch of key operators or vendors are very defensible in martech. Litmus is a classic example historically. Email providers have notoriously finicky rules around what renders in their systems and how, and they are not very transparent. Engineers and designers hate coding for email, and it’s hard for them to remember all the rules for all the different types of email clients. Litmus allowed you to preview what your emails looked like across all major clients to spot errors before you send the email, and generally became an all-encompassing email QA tool. No engineer internally wants to build that, and they will never be as good as Litmus at doing it because Litmus has been doing it for billions of emails, so it has seen many more cases, and has better integrations with email providers. Another example of removing engineering pain is Heap Analytics, which auto-tags events, removing one of the most painful parts of setting up a new analytics vendor.

Option 3: Leverage Cross Side Network Effects

A more modern example is the customer data platform companies Segment and mParticle. These companies integrate with hundreds of other companies marketers use for various purposes: web analytics, conversion tracking for performance marketing, crash reporting, et al. Integrating these companies saves engineers time because they integrate once, and any other solutions they need can now be enabled instantly. These integrations not only help marketing, but product, and engineering as well. These companies have created a cross side network effect between customers and other technology providers. Data platform companies are hard to rip out once you integrate because they are so integrated in all of your processes.

The Real Answer: Change the Target Customer

Okay, so all of these are great options, but they actually share one thing in common: they have really shifted the target customer to the engineer instead of the marketer. Sure, the marketer may be the person requesting the solution, but the solution is chosen because the engineers like it. Many things an engineer has to do are painful, and as much as engineers like to solve their own problems, if you show value to them, they will appreciate it. So I am very bullish on engtech companies masquerading as martech. Other examples of this besides the ones above are data visualization platforms like Mode and Periscope.

Bonus Option: Pick the Right Marketing Customer

One other strategy that is very successful for martech companies is to build targeted solutions for the types of companies where marketing is more central to the organization’s success. While marketing is ebbing in importance in most tech companies, one area it is thriving is in ecommerce companies, whose main playbooks are logistical on product delivery, and where brand + performance marketing drive all sales. The product is something delivered offline, so the product and engineering teams are more subservient to marketing than in other functions, and because the product is delivered offline, these teams usually have less engineers than other companies. Narvar is a great example for ecommerce tracking. Buffer is a great example for social media marketing. Canva is a great tool to help design creative for marketing campaigns and social media posts.

—

Martech is a very challenging space for an entrepreneur. If you are going to tackle it, there are distinct strategies like data network effects, pain management and maintenance, and cross side network effects that make it more possible to build a sustainable business. Approaching the right customers, either in role (engineering) or space (ecommerce) also make the road easier. If you have any other tips on building a great martech business, feel free to leave them in the comments.

Currently listening to Slide by George Clanton.

Addressing Common Misconceptions about Food Delivery Marketplaces

I spent five and a half years working at Grubhub, from series A to right before IPO. This allowed me to learn about many of the intricacies of the restaurant market and food delivery in general. More people have started to take notice of the market because of a slew of market entrants and Grubhub ($9.1B), Just Eat ($4.8B), and Delivery Hero ($7.2B) being successful on the public markets. With that, more articles in the press. Articles… that are wrong. I am reminded of the Murray Gell-Mann Amnesia Effect, invented by Michael Crichton, when I read these articles. It says:

Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.

As someone who does know, I want to explain some of these misconceptions, so people don’t think wet streets cause rain (even though rain does cause delivery orders).

Misconception #1: Restaurant Margins

One major gripe journalists cite about food delivery marketplaces (more so UberEats than Grubhub due to its higher fees) is that restaurants operate on slim margins. Therefore, if food delivery marketplaces are charging 15-30% for delivery orders, restaurants are not making any money. The issue is understanding the difference between restaurant margins and delivery margins, which are very different.

Most successful marketplaces are built on top of an under-utilized fixed asset. For food delivery marketplaces, this under-utilized fixed asset is not the restaurant, but the kitchen. Restaurants have a fixed capacity they can seat at a restaurant. The kitchen, however, is usually capable of producing much more food on a daily basis than is needed by the patrons that dine in the restaurants. Restaurants are paying for that kitchen capacity regardless of how much they use because one of the highest costs for most restaurants in cities is the cost of rent. That’s why I thought it was so silly when all of these delivery service startups started making their own food. You’re spending a lot of money to build what the incumbent gets for free: excess kitchen capacity to make food. This is why restaurants love catering orders so much. They get big orders that can better leverage their kitchen capacity. After catering, their next favorite is delivery.

Why delivery? It allows them to serve many more customers at a time with their fixed asset, spreading their fixed costs across many more customers. Catering and delivery are pretty much pure margin for restaurants because their only extra cost is a delivery driver (or not, in many cases) who is subsidized by the people ordering the food via tips.

Misconception #2: Paying for Repeat Orders

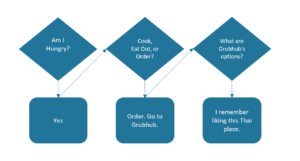

The second major gripe I hear about food delivery marketplaces is that they charge the same amount for a customer’s first order to a restaurant and repeat orders. Now, a lot of this is drummed up by a competitor who does not drive demand, so it is biased, but I’ll endear it. The misconception here is that all a restaurant has to do is pay an advertising fee to induce trial, and if the food is good, the customer will order again based on that experience. That is now how food delivery works. Food delivery is very fragmented, and while there is differentiation by way of restaurant quality, there are usually quite a few worthy substitutes. Also, the way delivery orderers usually make decisions is method first, restaurant last. The way the average person decides to use Grubhub operates something like this (flowchart):

Restaurant loyalty is one of the least important and last steps in the process of the person ordering food. This means people ordering food do not have loyalty, and you need to compete for every order as if it’s the first. Google Adwords does not charge Apartments.com less if someone who clicked their ad a year ago when searching “apartments” does so again the following year. The reason they don’t is because if Apartments.com wasn’t showing up there, that user would have gladly clicked the ad for ApartmentGuide. Restaurants should absolutely be working to build loyalty, and some do. But expecting that acquisition was the hard work, and restaurants should only pay a SAAS-level fee for retention does not align to the value these marketplaces actually create for restaurants.

Changes That Do Make Sense

Now, there are some elements I would change in regard to repeat orders if I worked at these marketplaces. While Grubhub already charges a much cheaper rate if the order originates from a restaurant’s own website, there are other forms of orders that the restaurant seemingly drives itself without the marketplace’s marketing engine or aggregation. One is if the person ordering food directly types the restaurant’s name into the marketplace. Charging a lower rate for that makes sense as the restaurant is clearly driving the business. I know from the data that this is a small percentage of orders, but this would show good faith to restaurants that marketplaces want to align their revenue model to the value they create.

Another scenario is if the person lands directly on the restaurant’s page on the marketplace from somewhere else e.g. Google. If this happens organically (because the marketplace ranks high or because the restaurant does not have its own website), the marketplace should charge a lower rate. The reality is Yelp and Google Local take 90% of this traffic, but again, it would send the right message.

The other example of this is a little harder to parse. These marketplaces also bid on restaurant names on Google. If that drives an online order, what should be the charge? The restaurant drove the demand, but the marketplace spent the advertising dollars to close the order. In this case, I think these marketplaces should evolve to asking if restaurants want this type of marketing, and if so, charge for the advertising as a service. This was not possible for Grubhub when I worked there due to game theory issues with all the competitors, but with a shrinking field of credible players, it may be possible.