Product-Market Fit Requires Arbitrage

Much has been discussed around product-market fit, but most of these discussions leave out the most key part: can you actually grow this business the way it exists today. I'll explain how to answer that question.

One of the most discussed topics for startup is product-market fit. Popularized by Marc Andreessen, product-market fit is defined as:

Product/market fit means being in a good market with a product that can satisfy that market.

Various growth people have attempted to quantify if you have reached product-market fit. Sean Ellis uses a survey model. Brian Balfour uses a cohort model. I prefer Brian's approach here, but it's missing an element that's crucial to growing a business that I want to talk about.

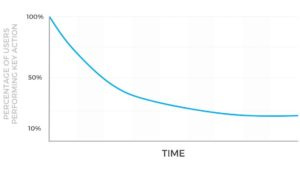

First, let's talk about what's key about Brian's model, a flattened retention curve. This is crucial as it shows a segment of people finding long term value in a product. So, let's look at what the retention curve shows us. It shows us the usage rates of the aggregation of users during a period of time, say, one month. If you need help building a retention curve, read this. A retention curve that is a candidate for product-market fit looks like this:

The y axis is the percent of users doing the core action of a product. The x axis in this case is months, but it can be any time unit that makes sense for the business. What makes this usage pattern a candidate for product-market fit is that the curve flattens, and does fairly quickly i.e. less than one year. What else do you need to know if you are at product-market fit? Well, how much revenue that curve represents per user, and can I acquire more people at a price less than that revenue.

If you are a revenue generating business, a cohort analysis can determine a lifetime value. If the core action is revenue generating, you can do one cohort for number of people who did at least one action, and another cohort for actions per user during the period, and another cohort for average transaction size for those who did the core action. All of this together signifies a lifetime value (active users x times active x revenue per transaction).

Now, an important decision for every startup is how do you define lifetime. I prefer to simplify this question instead to what is your intended payback period. What that means is how long you are willing to wait for an amount spent on a new user to get paid back to the business via that user's transactions. Obviously, every founder would like that to be on first purchase if possible, but that rarely is possible. The best way to answer this question is to look with your data how far out you can reasonably predict what users who come in today will do with some accuracy. For startups, this typically is not very far into the future, maybe three months. I typically advise startups to start at three months and increase it to six months over time. Later stage startups typically move to one year. I rarely would advise a company to have a payback period longer than one year as you need to start factoring in the time value of money, and predicting that far into the future is very hard for all but the most stable businesses.

So, if you have your retention curve and your payback period, to truly know if you are at product-market fit, you have to ask: can I acquire more customers at a price where I hit my payback period? If you can, you are at product-market fit, which means it's time to focus on growth and scaling. If you can't, you are not, and need to focus on improving your product. You either need to make more money per transaction or increase the amount of times users transact.

Some of you might be asking: what if you don't have a business model yet? The answer is simple then. Have a retention curve that flattens, and be able to grow customers organically at that same curve. If you can't do that and need to spend money on advertising to grow, you are not at product-market fit.

Other might also ask: what if you are a marketplace where acquisition can take place on both sides? If you acquire users on both sides at the wrong payback period, you'll spend more than you'll ever make. Well, most marketplaces use one side that they pay for to attract another side organically. Another strategy is to treat the supply side as a sunk cost because there are a finite amount of them. The last strategy here is to set very conservative payback periods on both supply and demand sides so that in addition they nowhere near add up to something more than the aggregate lifetime value for the company.

Currently listening to From Joy by Kyle Hall.