Monologue from The Devil’s Advocate (1997), starring Al Pacino and Keanu Reeves (Warning: contains language)

In the business world these days, most startups seem to follow a similar formula to attempt to have success. Every press release will say something about a company’s “millions of downloads” or “10 million users”. Savvy journalists call these “vanity metrics”, in that they make you feel good and on the surface might impress people, but they don’t really mean anything (what metrics do mean something is another blog post entirely, but they usually start with “active”). They’re also easy to manipulate with money. It’s easy to get a million people to buy a $1 gift card if you’re paying them $10 to do it.

On the entrepreneur side, the tactic is typically described as “fake it ’til you make it”. A less suggestive name that still applies if you aren’t faking anything can be called “get hype”. Whatever you call it, it’s almost universally accepted as a good strategy. I don’t necessarily disagree that it can be. But, I think it might be on its last legs as a viable strategy for a growth business. The speed of business today is, well, let’s just say it’s hard to keep up with. The reason entrepreneurs fake it ’til they make is that, like puffery, as much as people know it’s bullshit, the tactic works. Blogs and other media outlets print those stats, potential investors, acquirers, and users read them, and the stories drive sign-ups, fundings, and acquisitions. The problem is that those three groups also can form another group: your future competitors. And, a future competitor adopting your strategy, or, put in a less polite way, cloning you, becomes almost a guarantee. It used to take years for this to happen. Now, it takes weeks.

Now, your little project that may or may not have some traction (and you’re telling everyone it does) becomes a “space”, and, before you know it, you’re in a race. A race where you don’t know what the track looks like, don’t know what the rules are, don’t know if your competitors are running or driving a Ferrari against you, and don’t know what you win if you get to the end first. Sound ridiculous? Well, let’s look at a case of it happening right now.

In my Design and Business Inspirations post, I wrote about Postmates, an on demand service for same say shipping. Postmates, originally a B2B business, was having trouble getting business customers with existing relationships with FedEx, UPS, and the like on board. But, they noticed that affluent San Franciscans were using the app to request food from places that didn’t deliver. They pivoted their service to “Get It Now”, a consumer app to request food or product deliveries from local businesses, delivered by bike messengers looking for extra gigs. They started getting some usage, shot out a bunch of promotions to drive even more usage, and hit the press on May 17th about their successful pivot. They picked up a few more stories from a couple more places, and things were looking good. Investors surely saw these stories. They’re now in a good spot to pitch to investors about a Series A to help launch this in more cities.

If you go back to that original piece of press though, you’ll notice Postmates wasn’t the only company mentioned. Here is way the “get hype” strategy starts to hurt. The press loves to compare. And every company these days, if they’re not already reading the blog your press is in, is monitoring mentions of their brand in press (see my How to Track Your Brand Online post for how). The competitive response happens in record time for Postmates. On June 21st, TaskRabbit launches DeliverNow, a direct competitor. On August 1st, YCombinator-backed Instacart launches for one-hour shipping for groceries. On August 5th, eBay launches eBay Now for same day shipping on all products. On September 6th, Business Insider declares same-day-shipping the next billion-dollar startup opportunity. This all happened in four months. Soon, it’ll start happening even faster. Postmates still has not even raised that Series A yet.

Now, one could make the argument here that this was bound to happen whether Postmates existed or not, and that all this competition actually helps raise their profile (a picture of Postmates’ CEO in sunglasses was the lead picture of that Business Insider article). You may be right. But, I bet it makes fundraising that much harder when every investor asks you how you’re going to compete with TaskRabbit and Instacart and eBay and Amazon and Shutl and numerous others. It’s really hard to tell if hype helped or hurt their chances of success. This is just one example. If you’re a geographic business and go after a “get hype” strategy, prepare for competition to pop up in other areas and countries copying your business before you even get there.

Okay, sorry for the long rant, but it’s needed to show there’s another strategy that Mr. Pacino more than adequately describes in the above video. If, instead of focusing on convincing everyone you’re successful in order to become successful, you actually spend the time doing other things that make you not have to pretend, what can you do? I call companies that do this silent killers, because you don’t know what they’re doing until they’ve already crossed the finish line and you weren’t even in the race. If you’re a silent killer, you can actively not seek press, actively not publish your numbers, drop that PR agency entirely and not alert future competitors as to what you’re up to. This allows you to build a defensible business before anyone knows what you’re doing and get a real headstart on any future competition.

Now, it’s hard for me to describe a good example of this for a current startup (if so, they wouldn’t be very silent now, would they?), but I can tell you about an example from the tech world. The press loves to talk about the tech giants, even though the giants change all the time. First, it was Apple and Microsoft. Then Google and Yahoo. Then Microsoft and Google. Then Apple and Google. Now, Google and Facebook. Facebook used a “get hype” strategy to achieve $100 billion valuations in private markets with many pundits suggesting they would crush Google despite profits a tenth of Google’s. Instead, Facebook’s hype crashed its IPO, and its market cap is over 50% below peak valuations. Every other “get hype” IPO has suffered similar fates (Groupon and Zynga, most notably).

Facebook’s stock performance since its IPO (graph courtesy of YCharts)

Meanwhile, two silent killers have thrived. Amazon, which has been around for longer than Google, but until recently, has never been much discussed as a tech giant, wasn’t fighting it out in the press for mind share dominance. Instead, they acted like a silent killer. They had some engineers in South Africa innovate on cloud computing, entering a web services business with entrenched competitors that they totally out-innovated. With a debut in 2006, Amazon Web Services is now a $2 billion business, and one which no traditional web service company has been able to catch up to, despite having been working on web service solutions for tens of years longer than Amazon. Amazon Web Services was a not a “get hype” strategy. In fact, it probably couldn’t be. Most people still have no idea what cloud computing is. And that helps Amazon, because it means not just anyone can copy their strategy, because most don’t even understand it.

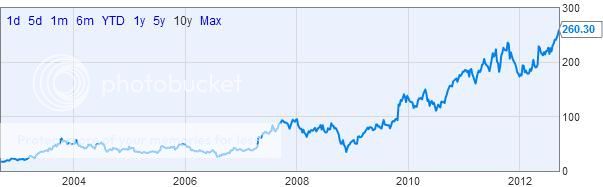

Amazon’s stock performance since launch of AWS in 2006 (graph courtesy of YCharts)

Another example is LinkedIn. LinkedIn launched as a business social network well before Facebook and grew steadily for years while MySpace and Facebook secured all the headlines. Instead of just growing users via a “get hype” strategy, it grew a business as well. While CareerBuilder and Monster spent billions trying to entice job seekers to post their resumes online for job openings, LinkedIn figured out that network referrals, not application processes, create the best candidates, and built tools for recruiters based on that premise. LinkedIn users gladly gave the company their resumes as content to build their profiles. LinkedIn IPO’s well before Facebook did, and their stock price jumped from a $35 offering to over $100 on the first day. After delivering solid results quarter after quarter, its stock price is at $120, whereas Facebook is down over 50% from its IPO price, and Monster’s stock is down from a peak of $57 to just $8.50. Other silent killer IPO’s have performed well also (examples include Zillow and Palo Alto Networks).

Now, this is not to say that the silent killer approach is for everyone. For example, as much as he may have wanted to, there is no way Jack Dorsey, the founder of Twitter, could have grown Square quietly. There are just too many eyes on him. Nor do I want to imply being a silent killer is a strategy you can pursue forever. Amazon is certainly no longer a silent killer, nor could it stay that way after it disrupted web services with AWS and content distribution with the Kindle. But for most companies, no one cares what you’re up to until you try to make them care. Using hype to make people care is a strategy you should carefully consider the pros and cons of in today’s environment. You may be better off building a silent killer and shocking the world when you’ve already won a multi-billion dollar race no one else knew had started yet.

Curious – is this an actively discussed and implemented strategy / philosophy at Grubhub?

Absolutely not.

Now might be good a time for a “views expressed here are entirely my own and do not necessarily reflect those of GrubHub” caveat.

Interesting. While I tend to agree that most of the time startup teams should focus on building a great product and customer experience instead of chasing headlines, PR and broad recognition may do a category-defining company good by helping it enter the general consciousness of potential customers and partners. ie expanding “the pie”.